London Wheat Report

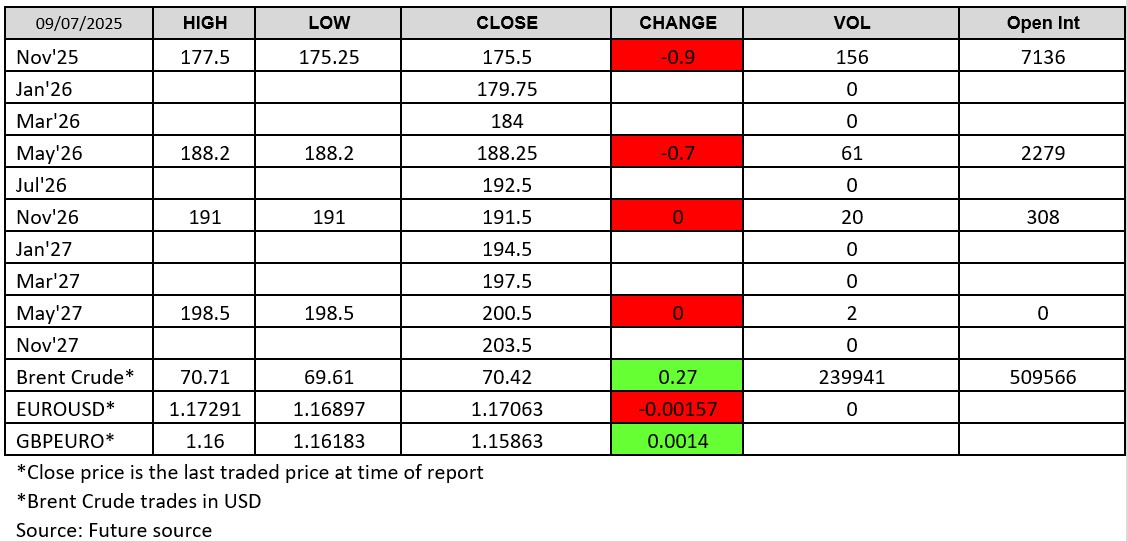

Today saw another slide on London wheat, with Nov-25 falling £0.90 and May-26 down £0.70. Additionally, today saw the first trade on the May-27, where 2 lots passed through, setting the tone at £198.50. Matif wheat fared slightly better, with all contracts ending the day in the green, following Chicago wheat’s earlier rise.

The main US wheat contract edged up to halt a three-session fall, but with an advancing northern hemisphere harvest keeping a lid on prices. Much attention within the grain markets is now also starting to turn towards the monthly supply and demand forecasts from the U.S. Department of Agriculture due to be released this coming Friday. Corn was also seen to somewhat recover from one-week lows today before giving up gains in the later part of the day. U.S. weather has been largely favourable for corn and soybeans, while in rival exporter Brazil some analysts predict the ongoing second-corn harvest will set a record like the soybean harvest earlier this year.

Further east, two of Russia’s top wheat-growing regions are having increasingly different years as the Rostov region endures a second year of drought; its nearby neighbour, Stavropol, has been bestowed with good weather and promises a record output. This change in fortunes should keep supply from the world’s largest exporter steady and could also see Stavropol dethrone Rostov as its biggest wheat-growing region.

Today’s (9/07/25) Matif Cot showed a trimming of Matif rapeseed long for the second week in a row:

Source: ADMISI

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Ryan Easterbrook, Aaron Stockley-Isted and Jamie Kirkwood

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.