Soybeans, soyoil, soymeal, corn and KC wheat ended higher. Chicago wheat ended lower. US Stocks were higher. Crude was higher. Gold was higher. US Dollar was lower.

SOYBEANS

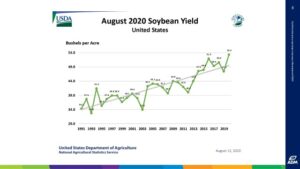

USDA August soybean crop report and 2020/21 supply and demand report was negative. Prices traded higher on talk of some consumer pricing and some short covering in front of the US and China trade talks. USDA estimated US 2020 soybean crop is near 4,425 mil bu versus 4,135 previous. Range of guesses were 4,135 to 4,399. USDA 2020 soybean yield is near 53.3. Some still feel final yield could be higher. USDA estimated record soybean yields in SD, MI, IL, IN, OH, MO, KY and LA. USDA estimated US 2020/21 soybean carryout is near 610 mil bu versus 425 previous. USDA also increase exports 75 mil bu and crush 10. USDA estimated World 2020/21 soybean end stocks near 95.3 mmt versus 95.0 previous and 95.0 last year. Weekly US old crop export sales are estimated near 100-550 mt versus 435 last week, new crop is estimated near 1,100-1,800 mt versus 1,405 last week. Today USDA Announced 258 mt new new crop soybeans sales to China and 120 mt to unknown.

CORN

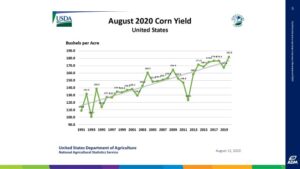

Corn futures traded higher. USDA August numbers were close To the average traded guess. Some feel there may have been some consumer pricing after USDA released the report. There continues to be a debate over how much Iowa corn Crop was damaged due to recent wind storm. Lack of US Farmer selling has helped the basis and spreads. Farmer has a record amount of corn to sell in 2020. USDA estimated US 2020 corn crop is near 15,278 mil bu versus USDA 15,000. This was the first official NASS crop estimate. Range of guesses were 14,925 to 15,401. USDA 2020 corn yield is near 181.8. Some still feel final yield could be higher. USDA will release first data for US farmer enrollment to crop insurance later today. Some feel the report could show more acres. USDA estimated record corn yields in WI, MI, MN SD, KY, TN, GA and SC. USDA estimated US 2020/21 corn carryout is near 2,756 mil bu versus 2,648 previous. USDA also increase exports 75 mil bu. USDA estimated World 2020/21 corn end stocks near 317.4 mmt versus 315.0 previous and 311.3 last year. Weekly US ethanol production was down 1 pct from last week and 12 pct from last year. Stocks were down 3 pct from last week and 17 pct from last year. Weekly US corn export sales are estimated near 400-1,400 mt versus 2,600 last week.

WHEAT

Wheat futures traded mixed after USDA August crop report and monthly supply and demand report. KC traded higher. Chicago traded lower. There may have been some pricing under the market after the report. USDA did raise Russia, Australia and Canada crop numbers and lowered EU. Some feel USDA is still low in Total world production. USDA estimated US 2020 wheat crop is near 1,838 mil bu versus 1,824 previous. Range of guesses were 1,799 to 1,856. USDA estimated the winter crop near 1,197 versus 1,216 expected and 1,218 last month. HRW was 695 versus 710 last month. USDA estimated the spring crop near 577 mil bu versus 560 expected. USDA estimated US 2020/21 wheat carryout is near 925 mil bu versus 942 previous. USDA increased exports 25 mil bu. USDA estimated World 2020/21 wheat end stocks near 316.8 mmt versus 314.8 previous and 300.9 last year. Weekly US Wheat export sales are estimated near 250-800 mt versus 605 last week.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.