Soybeans, soyoil, soymeal and nearby corn traded lower. Wheat traded higher. US stocks were higher. US Dollar was higher. Crude and Gold traded lower.

SOYBEANS

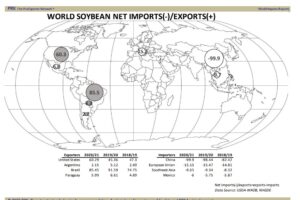

Soybean traded lower. SK remains in a broad range between 13.50 and 14.50. Slowdown in demand for US exports and a benign USDA April US and World supply and demand offers resistance. Fact that strong US cash soybean basis suggest a tighter US domestic situation than USDA will admit to offers support. Ultimately, US summer weather will be key of prices trade below support or above resistance. SBM continues to lose ground mostly on concern over China demand. USDA dropped China soybean crush 2 mmt to 96. Some feel this is due to ASF in China. Some feel China has control over ASF in the north but it is still spreading in the south. Soyoil should find support on talk US will increase biodiesel demand for jet fuel. World Oct-March soybean +soymeal trade is a record 80.7 mmt vs 75.3 ly. US soybean exports are near 50.5 mmt vs 29.0 ly. Brazil exports are near 19.8 vs 30.3 ly. USDA Oct-Sep goal is 180.0 mmt vs 175.0 ly.

CORN

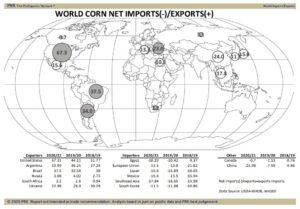

Corn futures closed mixed but off session highs. USDA did drop their guess of US 2020/21 corn carryout but only to the average trade guess. This was not enough to attract new buying. USDA raised US 2020/21 corn feed use, 50 mil bu, FSI 25 mil bu and exports 75 mil bu. This dropped USDA guess of US 2020/21 corn carryout to near 1,352 mil bu vs 1,502 last month and 1,919 last year. Most feel USDA is 100 mil bu to low in final domestic use and 200 mil bu to low in final exports. This could eventually lower final carryout closer to 1,052 and suggest higher prices. In May, USDA will have to construct a US 2021/22 US corn balance sheet that could show lower total supply and similar demand and may be a carryout below 1,000 mil bu. This will put additional pressure on a record yielding crop. Dec corn is too low. USDA left China corn imports are 24 mmt vs 29 mmt pace. US Midwest 2 week forecast calls for below normal temps and normal to below rains. This could slow corn plantings. Still US farmers can plant a lot of acres once weather warms. USDA raised World corn feed use 3 mmt to a record 731 mmt vs 714 ly. World corn trade was est near a record 187 mmt vs 171 ly. World end stocks were est at 283 mmt vs 287 last month and 302 ly. This week, head trade of one large Global grain company suggested increase export demand and drop is stocks could suggest higher prices and increased volatility.

WHEAT

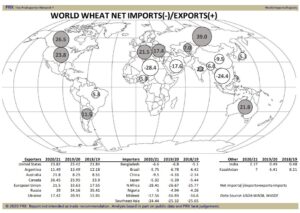

Wheat futures traded higher. USDA did not make a lot of changes to US or World supply and demand. Still concern about dryness across US north plains. Canada prairies and west EU is triggering new buying. USDA raised US wheat carryout 16 mil bu due in part to 10 mil bu lower imports and 25 mil bu lower feed use? Some feel HRW will be near 125 mil bu. USDA raised HRW carryout 28 mil bu, dropped HRS 3, dropped SRW 5 and durum 5. USDA dropped World wheat stocks 5 mmt due to lower China. Russia exports are 39.5 mmt vs 39.0 last month and 34.5 ly. EU exports are 27.5 vs 38.4 ly. Australia 22.0 vs 9.1 last year. WK is near 50 day moving average near 6.43. Trade over could attract mor buying. WK has rallied 53 cents from recent low. KWK trade over the 20 day moving average. Next resistance is near the 100 day and 6.00. MWK has rallied 62 cents from recent lows. MWK is near contract highs and 6.62. Continued dry US and Canada HRS weather should push MWK higher.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.