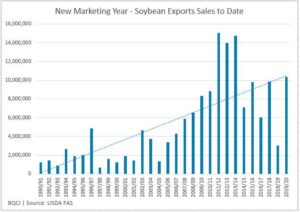

SOYBEANS

Soybeans traded higher on word of increase China buying US soybeans. USDA announced another 132 mt US soybean sold to China. There was also talk that China was a late buyer of US gulf soybean today. This was after USDA reported new crop weekly sales near 84 mil bu. Most of the increase was China and unknown. Total new crop soybean sales are near 381 mil bu or 4th largest since 1990. US Midwest temps should warm up this weekend. SW plains will be hot. First part of next week rains could fall across parts of ND, MN and IL. Midwest temps should moderate. Late next week rans could fall across NE, IA, MO, IL and IN. Interesting to note that water temps suggest a move away from La Nina. This could suggest favorable 2021 South America weather. World palmoil prices have surged to near $646 per tonne. The spread between World soyoil prices and palmoil has dropped to near $12 per tonne. Last year at this time soyoil was $143 dollars over palmoil. Weekly US soybean export sales were only 13 mil bu. Total commit is near 1,714 mil bu versus 1,785 last year. USDA goal is 1,650 versus 1,752 last year.

CORN

Corn futures traded unchanged. Some feel prices may be on hold until more is known about final US crop and demand. Fact USDA announced large new crop corn sales offered support. A mostly favorable US Midwest 2 week forecast appears to be limiting new buying in corn over key resistance. Slow World export trade is offering resistance to wheat. US Midwest temps should warm up this weekend. SW plains will be hot. First part of next week rains could fall across parts of ND, MN and IL. Midwest temps should moderate. Late next week rans could fall across NE, IA, MO, IL and IN. Weekly US corn export sales were only 8 mil bu. Total commit is near 1,721 mil bu versus 1,958 last year. USDA goal is 1,775 versus 2,066 last year. US corn prices are still above competitors. New crop sales jumped 92 mil bu. Most of the increase was China. Total new crop corn sales are near 303 mil bu or 4th largest since 1990. Talk of higher US final 2020 corn yield and disappointing weekly ethanol production is offering resistance to corn prices. Managed funds continue to add to short position. US farmer still has a lot of 2019 and 2020 corn yet to sell.

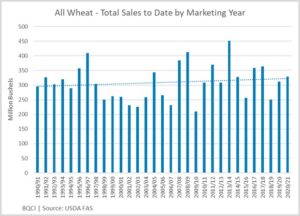

WHEAT

Wheat futures traded lower. Weekly US wheat export sales were near expectations. USDA did confirm China bought 2 cargoes of US SRW last week. Lack of big World wheat trade offers resistance to prices despite talk of lower supplies in Europe and Russia. Mostly favorable weather in Canada, Australia and Argentina also offers resistance to World prices. Interesting to note that water temps suggest a move away from La Nina. This could suggest favorable 2021 South America weather. Weekly US wheat export sales were near 22 mil bu. Total commit is near 328 mil bu versus 312 last year. USDA goal is 950 versus 965 last year. USDA est World 2020/21 wheat trade near 188 mmt versus 187 last year. Russia exports are 36 mmt vs 34 ly, EU 27 vs 38, Canada 24 vs 23, Australia 17 vs 9, Ukraine 17 vs 20. US exports are 25 mmt vs 26 last year. Largest importers are N Africa 29 mmt, SE Asia 26 mmt and Middle East 18 mmt.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.