Soybeans, soymeal, soyoil corn and wheat traded lower. Some feel this is a correction of an overbought technical picture. China is still buying US soybean and corn. Some feel US harvest could put a top in soybean and corn prices. US stocks are higher led by tech stocks. Crude is higher as Hurricane Sally enters US gulf coast.

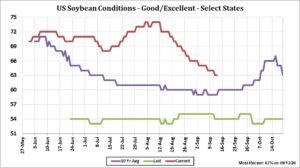

SOYBEANS

Soybean futures turned lower after making new highs for the year. Recent rally may have been fueled by China buying US soybeans. Some feel the lower trade today was overdue given fact Soybean futures were very overbought. Still supply bears feel once China slows buying US soybeans and switch to buying Brazil futures could be near a top until after US harvest. US Q4 soybean export demand will be record. 1,285 mil US soybean will be shipped from gulf in 2020/21. That is up 230 mil bu from last year. PNW soybean exports will be near 535 mil bu or up 140 from last year. Much of the demand will come from IL moving 390 mil bu out of state, ND 200, MN 170, SD 165, NE 165 and OH 160.Fact USDA estimated US 2020 soybean crop near 4,313 mil bu versus 4,425 last month and 2020/21 US carryout near 460 versus 610 last month is supportive. US August NOPA soybean crush was 165.0 mil bu versus 169.5 expected and 168.0 last year.

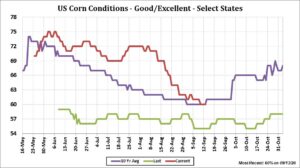

CORN

Corn futures traded lower. Dry August has helped move futures higher and lowered US 2020 corn crop and US 2020/21 carryout. Mondays trade has been higher before USDA weekly crop ratings. China buying US corn has also helped prices. Some feel approaching US harvest could put a top in futures through harvest. During the recent rally open interest has gone up 100,000 contracts. US farmer continues to be a slow seller of cash until he sees what his yields are. Commercials stepped in a stopped Sep deliveries. Weekly US ethanol production should be same as last week. Production could begin to trend lower due to normal maintenance. Stocks should increase from last week. 1,245 mil US corn will be shipped from gulf in 2020/21. That is up 215 mil bu from last year. PNW corn exports will be near 580 mil bu or up 235 from last year.US will also ship 270 mil bu from gulf to Mexico and 410 mil bu to Mexico by rail. Much of the demand will come from IL moving 765 mil bu out of state, MN 755, NE 605 SD 165, IA 410 and OH 250. Fact USDA estimated US 2020 corn crop near 14,900 mil bu versus 15,278 last month and carryout near 2,503 versus 2,756 last month has also helped prices.

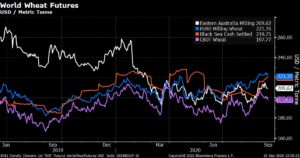

WHEAT

Wheat futures traded lower. Some feel wheat futures were more of a follower due to higher corn and soybean prices. Some feel, wheat futures are overvalued due to record large World supplies. Lower Russia new crop export prices may have weighed on futures today. USDA estimated World 2020/21 wheat crop near 770 mmt versus 764 last year. EU is 136 versus 155, China 136 versus 133, Russia and Ukraine 105 versus 102, Australia 28 versus 15, Canada 36 versus 32. USDA also estimated World trade near 189 mmt versus 190 last year, Russia and Ukraine 55 versus 55 last year, EU 25 versus 28 and Australia 19 versus 9. USDA estimates World wheat stocks near 319 mmt versus 299 last year and 284 in 2018/19. USDA estimated US 2021 winter wheat crop seedings 10 pct done. Soil conditions have improved for planting. WZ has rallied 50 cents from recent lows on low volume. Open interest increased 32,000 contracts.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.