Soybeans, soymeal, soyoil and corn traded lower. Wheat was higher. US stocks were higher. US Dollar turned lower. Gold was higher. Crude was higher.

SOYBEANS

Soybeans traded lower despite record weekly US soybean export sales. Some feel selloff was due to lack of new daily soybean export sales, weak technical action and approaching US harvest. US 2 week and 30 day weather forecast calls for below normal rains. SX traded back below 10.00. Some now look for SX range to be near 9.30-101.0 into late November. Historically the harvest low is made when 50 pct of US harvest is done. Weekly US soybean export sales were a record 3.2 mmt. Total commit is near 35.5 mmt versus 12.1 last year. USDA goal is 57.8 mmt versus 45.7 last year. USDA estimate World soybean trade near 166.3 mmt versus 165.8 last year. China imports are estimated near 99.0 mmt versus 98.0 last year. Today total US soybean sales to China is near 19 mt and unknown is 10 mmt. This suggest total US soybean sales to China could be near 29 mmt. Some feel China will take a total of 32 mmt US soybean. Central Brazil and most of Argentina remain dry.Argentina lowered their estimate of the 2021 soybean crop to 46.5 mmt versus USDA 53.5. China soymeal futures traded lower. Malaysian palmoil futures traded lower and now has taken back 10 pct of its value in 4 days.

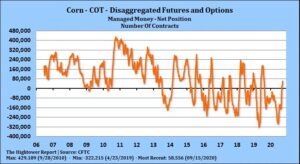

CORN

Corn futures traded lower despite better than expected weekly US export sales. Some of the selling was linked to profit talking and squaring positions before US harvest. Most still feel US farmer may try to store as much of the harvest as they can. This years crop is also slow to dry down so farmers are waiting for the crop to dry down. US Midwest 2 week and 30 day forecast is for below normal rains and below normal temps. China corn futures continue to trade lower as they also begin to start their harvest. Weekly US corn export sales were 2.1 mmt. Total commit is near 22.5 mmt versus 9.1 last year. USDA goal is 59.0 mmt versus 44.8 last year. USDA estimate World corn trade near 186.0 mmt versus 170.3last year. China imports are estimated near 7.0 mmt versus 7.0 last year. US corn sales to China is near 9.8 mmt. There is also 2.8 mmt in unknown for a total of 12.6. Some feel China could take 15.0 mmt US corn. Central Brazil and most of Argentina remain dry. Argentina lowered their 2021 corn crop to 47.0 mmt from USDA 50.0 due to dryness. Argentina farmer may have also reduced planted acres due to lower net returns. US hog report showed hog numbers near 101 pct of last year. Cattle on feed should show placements near 103 pct of last year. Some feel CZ range will be 3.40-3.80 through the end of November.

WHEAT

Wheat futures closed mixed. Gyrations in the US Dollar adds to wheat volatility. WZ traded near 5.51. WN21 traded 5.61. KWZ traded near 4.84. KWN21 traded near 5.07. MWZ traded near 5.34. MWN21 traded near 5.62. Paris wheat futures traded lower. Concern about export demand and rains in west and north Europe offered resistance. Russian wheat prices remain firm due to dryness and lack of farmer selling. This despite the fact Ruble is near 5 month low. Argentina lowered their wheat crop to 17.5 mmt versus USDA 19.5 due to dryness there. Weekly US wheat export sales were a record 351 mt. Total commit is near 13.4 mmt versus 12.5 last year. USDA goal is 26.5 mmt versus 26.2 last year. USDA estimates total World wheat trade near 189.4 mmt versus 190.3 last year. Since May, 2019 WZ has been in a 5.00-5.80 trading range. Covid raises concern about food demand and global economic recovery while dry weather in key export countries offers support. WN support is near 5.43 with resistance near 5.60. Next support is near 5.26.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.