SOYBEANS

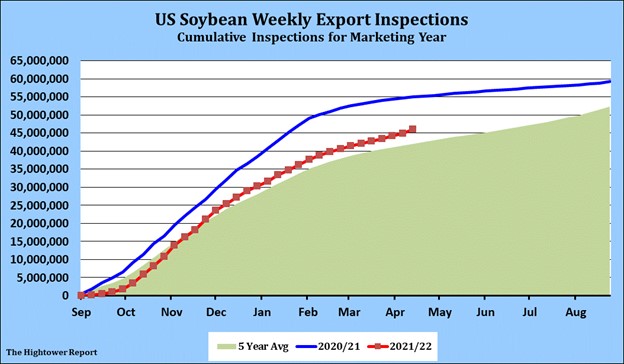

Soybean futures ended mixed. Risk off for most commodities due to concern about lower China economy and possible drop in commodity imports offered resistance. Fact US soybeans are competitive after July offers support. Flash US soybean sale to unknown also offered support. Some feel US 2021/22 soybean exports and crush could be higher than latest USDA estimate which could also support SN. US soybean exports are down 17 pct versus last year. US soybean planting is 1 pct versus 2 average. Even with futures near 17.00 higher demand for US exports and crush suggest futures should go higher.

CORN

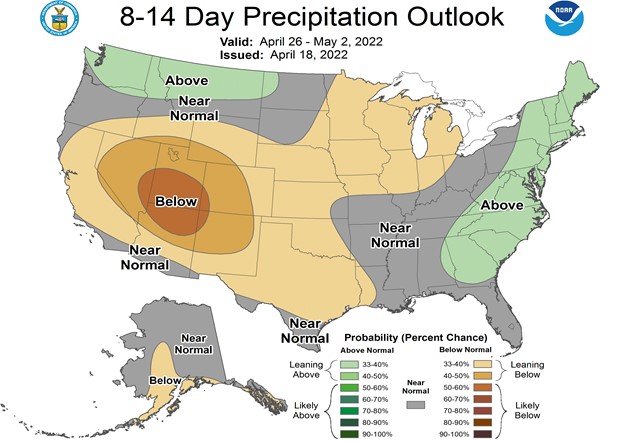

Corn futures ended lower. Some feel Corn futures may be overbought and due for a correction. USDA released a lot of numbers Monday. US corn exports are down 16 pct versus last year. US corn planting is 4 pct versus 6 average. This week should be wet and cool and could delay planting. Next week looks drier but could still be cool. Most feel forecast suggest US farmers will get the intended corn acres planted on time. Even with futures near 8.00 higher demand for US exports, ethanol and feed Suggest futures should go higher. There are reports that there are 57 grain and oilseed vessels locked in Ukraine ports. This is equal to 1.25 mmt of grain. War continues and now is escalating in east Ukraine. Some fear this grain could begin to spoil. USDA lowered Ukraine corn exports to 23.0 mmt and raised stocks to 6.5 mmt. Some feel exports could be below 20.0 mmt. USDA estimates US 2021/22 corn exports near 63.5 mmt vs 69.9 ly. Some could see final exports closer to 70.0 mmt. USDA estimates US corn end stocks near 36.5 mmt v 31.3 ly. Some feel final stocks could be closer to 29.2.

WHEAT

Wheat futures closed lower today as many commodities took off risk. Selloff was led by Crude oil on demand worries. US wheat exports are down 18 pct versus last year. US spring wheat planting is 8 pct versus 9 average. 2 week forecast is for more cold weather which could slow spring plantings even more. USDA dropped US winter wheat crop rating 2 pct to 30 G/E. Last Thursday WN was down 33 cents. Mondays range was up 34 cents following the long weekend and concern about US south plains weather. Todays range was down 38 cents. Who is driving this bus? Even with futures near 12.00 lower US 2022 HRW crop suggest KWN could go higher.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.