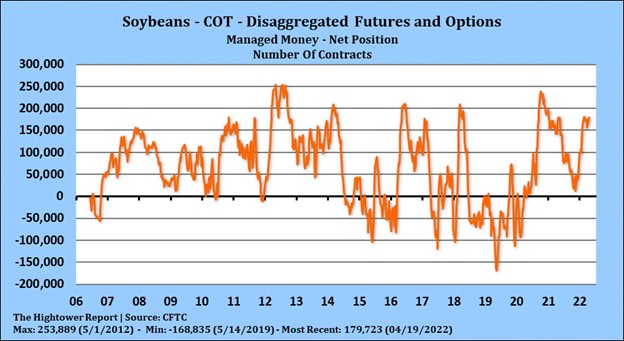

SOYBEANS

Soybean ended lower. Many commodities were lower on increase concern about increase China covid lockdowns could reduce their feed and fuel import demand. SN did test 16.95 on talk of higher US soybean demand due to lower South America supply. Most est US 2021/22 soybean carryout near 160-230 mil bu vs USDA 260. US 2022/23 soybean carryout is est near 200-250 vs USDA 390. Weekly soybean exports were 22 mil bu vs 10 ly. Season to date exports are 1,373 vs 1,630 ly. Soybean price direction up to China demand, money flow with futures above value which increase fund risk versus talk of dry US WCB summer. USDA announced 534 mt US soybeans to China. US soybean seeding is est at 3 pct vs 1 last week and 5 average.

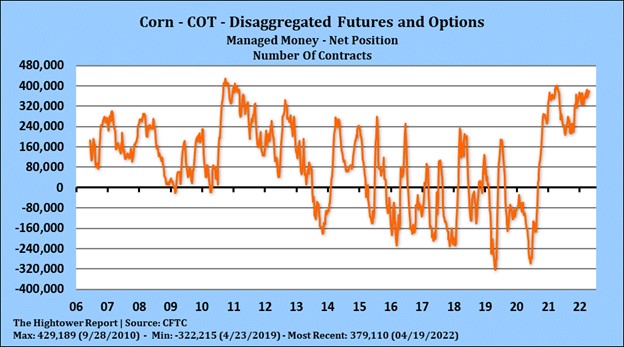

CORN

Corn futures ended higher. Despite the fact Ukraine may not ship corn as Russia increase attack on Ukraine port cities, concern and slower Global economies is offering resistance. US Midwest forecast could help spring plantings. US weekend rains were in IA, MN, N IL and MI. Most est US 2021/22 corn carryout near 1,200-1,300 mil bu vs USDA 1,440. Some estimate US 2021/22 corn exports near 2,700 mil bu vs 2,500 and ethanol near 5,425 versus USDA 5,375. Most feel feed use will be 5,625. US 2022/23 corn carryout is est near 1,070-1,200 vs USDA 1,413. This includes planted acres near 90.0, yield near 180.0, feed us 5.650, ethanol 5.400 and exports near 2,400. USDA Dalian corn futures were lower. Brazil corn futures near record high. Weekly corn exports were 65 mil bu vs 77 ly. Season to date exports are 1,712 vs 2,039 ly. Corn price direction up to Ukraine exports, lower SA export prices, lower Brazil corn crop and futures above value which increase fund risk versus talk of dry US WCB summer. US corn seeding is est at 9 pct versus 4 lw and 14 average.

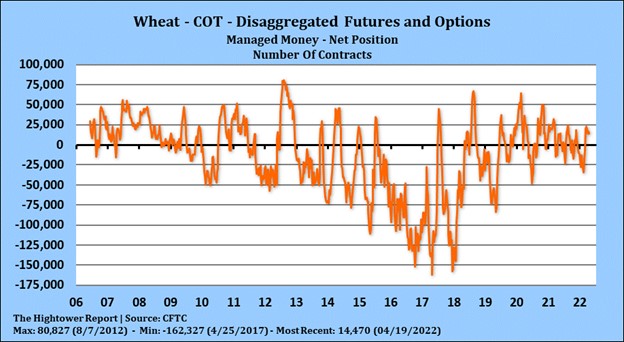

WHEAT

Wheat futures ended mixed. Like most commodities, wheat traded higher overnight on concern about lower Black Sea wheat exports. There is also concern that a dry weather pattern cold lower US HRW crop and wet weather could lower US HRS acres. Weekly wheat exports were 10 mil bu vs 21 ly. Season to date exports are 675 vs 832 ly. Wheat price direction up to Russia exports and 2022 north hemisphere wheat crop sizes. Trade estimates US HRW crop 30 pct G/E and spring wheat seeding 12 pct vs 16 average. Most est US 2021/22 wheat carryout near USDA 678. US 2022/23 wheat carryout is est near 500-814 vs USDA 731. Key is final US/World 2022 supplies. WN range was 10.55 -10.89 and ended near 10.72. KWN range was 11.38 -11.63 and ended near 11.59. KWN range was 11.56 -11.81 and ended near 11.77. ON range was 7.13-7.46 and ended near 7.46.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.