SOYBEANS

Soybeans traded higher. Higher US domestic basis on fears of supply less than demand and concern about US summer weather pushed soybean futures to new highs. Fundamentals suggest the trend could continue higher. Some look for nearby soybeans to test 16.00, 16.25 then 17.00. Same group could see nearby soymeal test 431, then 470. They could also see nearby soyoil test 70 cents. Some still feel US 2020/21 soybean carryout below USDA 120 mil bu. There is talk that Brazil soybeans may now work into US. US 2021 acres times trend yield suggest a US 2021/22 soybean carryout near 25. US summer weather will need to be perfect or SX could also trade higher and over 14.00. Weekly US soybean exports were near 8 mil bu. Season to date exports are near 2,031 mil vs 1,227 last year. USDA goal is 2,280. Most feel US soybean crush margins remain positive and crush are bidding up for soybeans. US soybean planting should be near 8 pct vs 3 last week.

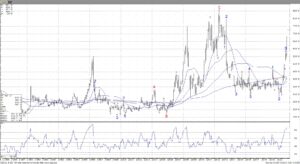

Nearby Monthly soybean futures chart

CORN

Nearby May and July corn futures contracts traded up the daily price limit. Synthetics were trading 686 ¼ CK and 658 ¾ CN. Talk of lower Brazil 2021 crop, higher US exports, higher US domestic use and basis levels and a drier than normal US summer pushed futures higher. For now, May weather should help US corn planting. Still most feel US farmers may not increase corn acres from the USDA March intentions due to increase cost. Trade est US corn planting near 17 pct done vs 8 last week. Last week, corn futures had the largest weekly gain since July, 2012. Weekly US corn exports were near 77 mil bu vs 61 last week and 42 last year. Season to date exports are near 1,623 mil bu vs 883 last year. USDA goal is 2,675. China exports were near 25 mil bu. Some feel their loading could reach 27-30 mil bu per week to export their open and unshipped sales. Most look for their imports to reach 32-33 mmt vs USDA 24 guess. There is talk that final Brazil corn crop could drop to 92 mmt vs USDA 109. This could reduce their exports by 10-12 mmt. Brazil may need to imports corn into July and they may have little to export August through Jan, 2022. Some feel next objective of nearby corn could be 7.10 then 7.50 then 8.00.

Monthly nearby corn futures chart

WHEAT

Wheat futures traded sharply higher. All 3 US futures traded over 7.00. WK is near 7.39, KWK is near 7.01 and MWK is near 7.41. US wheat exports remain uncompetitive to World buyers. Weekly US wheat exports were near 21 mil bu vs 23 last week and 18 last year. Season to date exports are near 830 million vs 827 last year. USDA goal including flour is 985 mil bu. US wheat futures remain a follower to corn to reduce increase in already record World wheat feeding. Concern about US north plains and Canada summer weather could push wheat futures higher. Matif wheat futures continued to trade higher on concerns about 2021 west Europe crop conditions and uncertainty over Black Sea 2021 export policy. Like corn and soybean, World 2021 wheat crops need to be almost perfect of World end stocks could drop especially for World exporters. Trade looks for US winter wheat crop to be rated 52 pct G/E vs 53 last week. US spring wheat planting should be near 28 pct vs 19 last week. Goldman Commodity Index made new highs. Copper, Coffee, Cocoa, Sugar, lumber and meats all traded higher.

Nearby Monthly Chicago wheat futures chart

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.