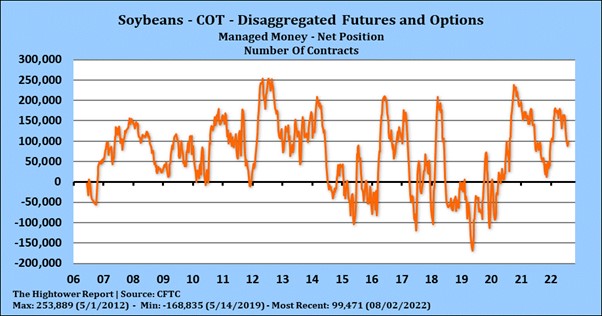

SOYBEANS

Nearby soybean futures ended higher. Fact USDA announce 132 mt new crop US soybeans to China offered support. There remains a big debate about China economy and given strain on US and China relations over Taiwan and how much US soybeans China will buy from US. Managed funds continue to be reluctant buyers of grains due to fear inflation will trigger US Fed to increase interest rates another 75 basis points in September. Funds also reluctant buyers of commodities until Crude oil chart turns higher. Weekly US soybean exports were near 32 mil bu vs 22 last week. Season to date exports are 2,003 mil bu vs 2,148 ly. USDA goal is 2,170 vs 2,261 ly. Some are lowering their export estimate 20 mil bu. Some feel new green bill passed by Senate could increase demand for US soybean acres by 20 million by 2025. Key is final US 2022 soybean supply and China demand for US soybeans. Trade looks for USDA to drop US weekly soybean crop rating to 59 pct G/E from 60 last week.

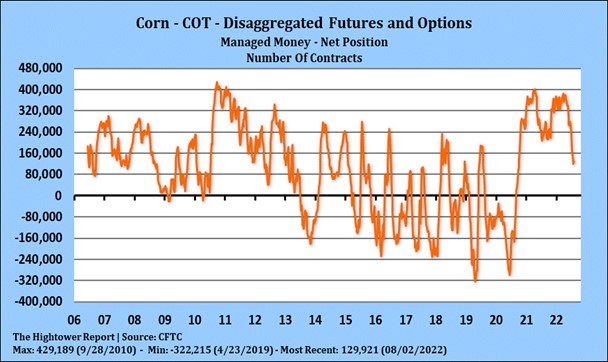

CORN

Corn futures ended slightly lower and remain in a tight range. Managed funds continue to be reluctant buyers of grains due to fear inflation will trigger US Fed to increase interest rates another 75 basis points in September after Fridays US jobs report. Funds also reluctant buyers of commodities until Crude oil chart turns higher. Weekly US corn exports were near 22 mil bu vs 35 last week. Season to date exports are 2,068 mil bu vs 2,515 ly. USDA goal is 2,450 vs 2,753 ly. Some are lowering their export estimate 50 mil bu and ethanol 40 mil bu. Key is final US 2022 corn supply and demand for US corn. EU needs corn. US prices and now a discount to Brazil. USDA reported that 105 mt of new crop US corn was sold to Italy. USDA also announced 120 mt of new crop US corn was sold to unknown rumored to be Spain. Some feel EU could imports as much as 5 mmt or 200 mil bu of US corn. This could drop US 2022/23 corn carryout below 1,300 mil bu. Italy normally buys their corn from either Ukraine or Brazil. US corn export prices are now a discount to US. First Ukraine corn export boat does now not have a home. Most of the 20 boats loaded in April, have been sold to unknown. Boat thought to be sold to Lebanon is too large to be unloaded in Lebanon. Trade est that USDA will drop US corn rating to 60 pct G/E vs 61 last week. Our weather guy is watching forecasted dryness across S/W IA, NE, KS, N MO and WC Illinois. 10 pct drop in KS, MO corn yield corn drop US corn yield 3 bpa.

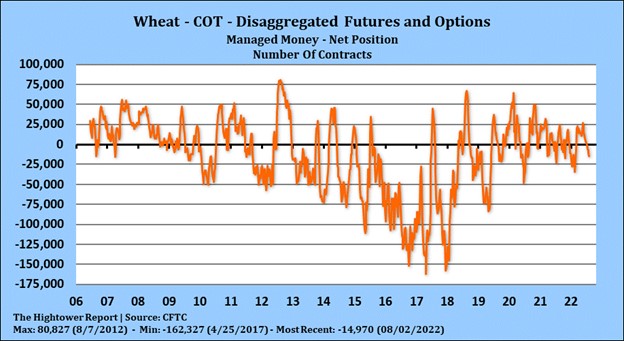

WHEAT

Wheat futures ended mixed. WU ended near 7.79 with a range of 7.60-7.93. KWU ended near 8.49 with a range of 8.29-8.62. MWU ended near 8.80 with a range of 8.74-8.99. Managed funds continue to be reluctant buyers of grains due to fear inflation will trigger US Fed to increase interest rates another 75 basis points in September after Fridays US jobs report. Funds also reluctant buyers of commodities until Crude oil chart turns higher. Weekly US wheat exports were near 22 mil bu vs 11 last week. Season to date exports are 128 mil bu vs 163 ly. USDA goal is 800 vs 804 ly. Some are lowering their feed estimate 20 mil bu and raising US crop 20 mil bu. Key is final Russian and EU wheat exports versus World import demand. US south plains weather forecast is warm and dry for 2023 planting season. S Russia will be hot and dry later this week. Trade estimates US Spring wheat crop at 70 pct G/E vs 70 last week. US Spring wheat harvest is est near 9 pct. US winter wheat harvest at 89 pct.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.