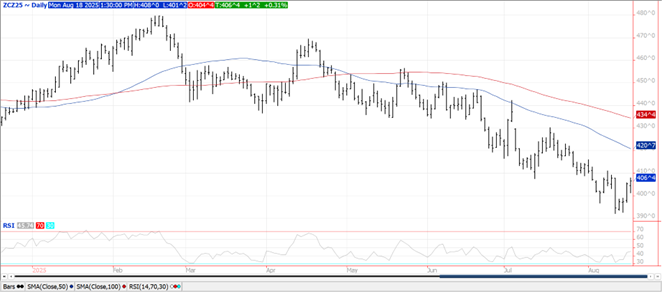

CORN

Prices ranged from $.01 lower to $.02 higher today in two-sided trade. Spreads also weakened. Near-term resistance for Dec-25 rests at $4.11. Reports from the ProFarmer crop tour show strong yield potential in SD on the western leg of the tour, while dry conditions in IN/OH along with some reporting pollination issues from the midsummer heat are being reported in the east. Export inspections at 41 mil. bu., were at the low end of expectations and below the 53 mil. bu. needed to reach the revised USDA forecast of 2.820 bil. bu. YTD inspections at 2.528 bil. are up 28% from YA vs. the USDA forecast of up 25%. The USDA also announced the sale of 124k mt (5 mil. bu.) to an unknown buyer. Money managers were net sellers of only 2,364 contracts in the week ended Tues. Aug. 12th extending their short position to 176k, much less than expectations of nearly 200k. AgRural reports Brazil’s 2nd crop 24/25 harvest has reached 94% as of last Thursday, while planting progress for the 2025/26 crop reach nearly 2%.

SOYBEANS

Prices were little changed and mixed across the complex with beans down $.01-$.02, meal was off $3 while bean oil was up 10-20 points. Beans and oil spreads were mixed while meal spreads weakened. Near term resistance for Nov-25 soybean is at last week’s high at $10.49 ¼. Support is at the 100 day MA at $10.26. The 50-day MA at 53.56 capped today’s rebound in Sept-25 bean oil. Sept-25 meal violated support at its 50 day MA at $280.80. Spot board crush margins slipped another $.04 ½ to $1.82 bu. while bean oil PV improved to 48.7%. New crop margins slipped $.03 ½ to $1.87 ½. Export inspections at 17 mil. bu. were in line with expectations and above the 13 mil. needed to reach the revised USDA forecast of 1.875 bil. YTD inspections at 1.796 bil. are up 12% from YA, vs. the USDA forecast of up 11%. Friday’s CFTC report showed MM’s were net buyers of nearly 31k soybeans, just over 24k meal while selling 10.5k contracts of soybean oil. Their short position in soybeans was trimmed to 35k, 109k in meal while their long position in oil dropped to 44.4k. With soybean plantings ready to kick-off next month in Brazil, a major state run lender Banco do Brasil is reporting defaults on agribusiness loans have risen to 3.5% in Q2, up from 3% the previous quarter and well above the 1.3% a year ago. As of this writing, talks appeared to have gone much better than Zelensky’s last visit to the Oval Office in Feb-25. While territory was discussed in today’s meeting, no specifics were provided. Pres. Trump did indicate the US would support Europe in providing security guarantees for Ukraine as part of a peace deal with Russia, something that Trump claims Putin is willing to accept. Next step is a trilateral meeting that would include Putin.

WHEAT

Prices ranged from steady to $.03 lower across the three classes. Sept-25 CGO matched LW’s contract low however continues to hold support just above $5.00. Same story for Sept-25 KC. New contract low for Sept-25 MIAX. Export inspections at 15 mil. bu. were at the low end of expectations and below the 17 mil. needed to reach the revised USDA forecast of 1.875 bil. YTD inspections at 177 mil. bu. are up 4% from YA, vs. the USDA forecast of up 6%. SovEcon expects Russia’s grain exports will rebound to 4.5 mmt, up from only 2.9 mmt in July. IKAR raised their Russian production forecast 1 mmt to 85.5 mmt, above the USDA forecast of 83.5 mmt. IKAR also raised their export forecast to 42.5 mmt, well above the USDA at 39 mmt. Egypt’s Ag. Ministry has reportedly purchased 4 mmt of wheat from local harvest since April-25.

Charts provided by QST.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.