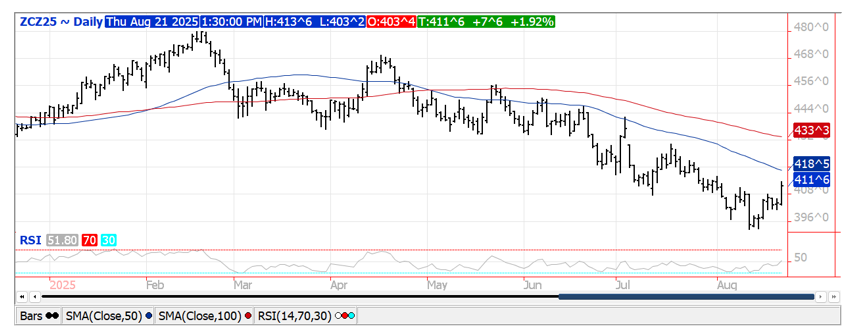

CORN

Prices were $.07-$.08 higher surging to its highest level in nearly 3 weeks. Next resistance for Dec-25 is at this month’s high of $4.16, followed by the 50 day MA currently $4.18 ½. Although the Sept/Dec spread widened to a new low at ($.24 1/2), new crop spreads all firmed. The PF tour is forecasting IL corn yields just below 200 bpa, down from their 204 bpa forecast last year and well below the USDA record yield forecast last week at 221 bpa. In W. Iowa they witnessed strong yield potential however disease risk was still also noted. PF will issue their state wide est. for IA this evening, with the overall US yield and production tomorrow. New crop exports at 113 mil. bu. were well above expectations. Old crop commitments slipped to 2.776 bil. still up 26% from YA, vs. the USDA forecast of up 25%. New crop commitments surged to 657 mil. more than double the YA pace and the highest in 4 years. New crop sales represent 23% of the USDA forecast, vs. the historical average of 18%. Noted buyers were unknown – 37.5 mil., Mexico – 29.5 mil. while Japan, Colombia, Korea and Spain all bought between 6-8 mil. Dec-25 corn exceeded the top end of my expected trading range of $3.80-$4.10.

SOYBEANS

Prices were mostly higher across the complex with beans surging $.15-$.20, meal ranged from up $5 in Sept-25 to down $4 in back months, while oil was up nearly $.02 ½ lb. Nearby meal spreads continue to surge as hand to mouth buying by end users appears to have left them in short supply. There was also net cancellations of 34 contracts registered for delivery with the CME against soybean meal futures. While a new low in the Sept/Nov bean spread, back months all firmed. Oil spreads were slightly higher on the price surge. New high for the month in Nov-25 beans with next resistance the July high at $10.58 ½. Sept-25 oil held support overnight at the 100 day MA. Today’s rally topped out near the 50 day MA. Reuters reported this AM the EPA is expected to rule on a number of the 195 pending SRE requests as early as tomorrow. These requests seek relief from the nation’s biofuel blending mandates. Some of these requests date back as far as 2016. Sources suggest rulings will be mixed, including some partial denials however not a sweeping win for small refineries. The EPA will also seek public comment on whether they should force larger refiners to make up for the exempted gallons. Spot board crush margins surged $.18 today to $2.08 ½ bu. with bean oil PV back up to 47.5%. IL pod count data was a record high at 1,479 pods per 3×3’ square. The USDA is forecasting IL soybeans yield at 65 bpa matching the state record from 4 years ago. Pod counts in IA have been running well over YA and the 3-year Ave. Bean exports at 42 mil. bu. all new crop, were at the high end of expectations. Old crop commitments at 1.876 bil. are up 11.5% from YA vs. the USDA forecast of up 10%. New crop sales at 215 mil. bu. are down 22% YOY and represent only 13% of the USDA forecast, vs. the historical average of 26%. Still no sale on the books to China. Soybean meal sales at 222k tons were in line with expectations. Old crop commitments are up 13% from YA, in line with the USDA forecast. Bean oil sales at 5.7 mil. lbs. brought old crop commitments to 2.407 bil. lbs. represent 94% of the USDA forecast.

WHEAT

Prices ranged from $.01 lower to $.03 higher across the three classes, gathering little support from higher corn and soybeans prices. With the exception of Sept/Dec spreads have firmed in both CGO and KC. Sept-25 KC has so far held within yesterday’s range. Exports sales at 19 mil. bu. were at the low end of expectations. YTD commitments at 424 mil. bu. are the highest in 5 years and up 23% from YA, vs. the USDA forecast of up 6%. Commitments represent 48% of the USDA forecast, above the historical average of 43%. HRW continues to garner a large portion of the sales at 15.5 mil. bu. last week. The YTD commitments for HRW at 178 mil. bu. are up 118% from YA, vs. the USDA forecast of up 38%. Early next week brings prospects for healthy rains across the S. plains which may stretch into the Northern Delta region by the middle of next week. The International Grains Council raised their 25/26 production forecast 3 mmt to 811 mmt,, above the USDA forecast at 807 mmt.

Charts provided by QST.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.