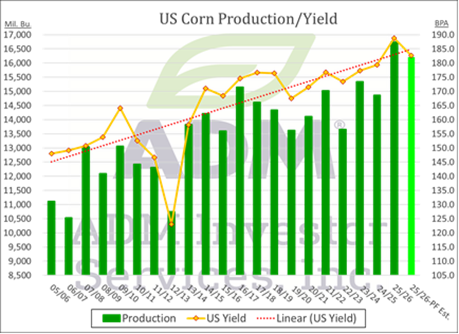

CORN

Prices closed within a penny of unchanged in 2 sided trade. Dec-25 held within yesterday’s range. Although Sept/Dec has carved out a fresh low, the spread rebounded late to narrow up $.01 ¼. Overhead resistance for Dec-25 is at the 50 day MA at $4.18 which could be challenged Sunday night with the lower than expected production forecast from PF after today’s close. They est. the US 2025 corn crop at 16.204 bil. bu., 538 mil. below the USDA est. in August. Their average yield forecast at 182.7 bpa is well below the USDA est. of 188.8 bpa. The USDA announced sales of 120k mt (4.7 mil. bu.) to Costa Rica and 140.5k mt (5.5 mil. bu.) to Spain. Heat and drought stress is taking a toll on France’s corn crop where conditions slipped 3% LW to 62% G/E, well below the 76% YA. The BAGE reports Argentine harvest advanced 1% LW to 96% complete while maintaining their production forecast at 49 mmt, vs. the USDA est. of 50 mmt. Cattle on feed as of Aug. 1st at 98% of YA was in line with expectations. Placements at 94% were above expectations of 91% while marketing at 94% were in line with expectations.

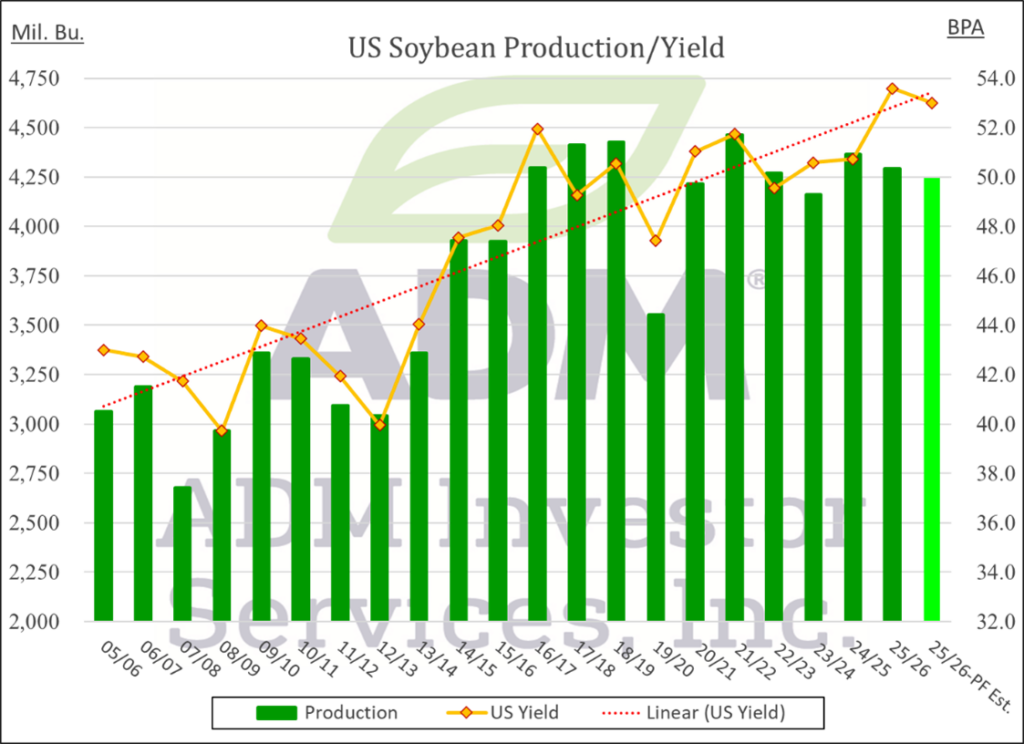

SOYBEANS

Prices were mixed with beans up $.02-$.03, meal was steady to $3 lower while oil closed 120-145 points higher. Meal spreads continue to surge as hand-to-mouth buyers appear to be in short supply. There were net cancellations of another 97 contracts registered for delivery with the CME against soybean meal futures. Nearby bean spreads softened while back months have firmed. Oil spreads weakened on the price surge. Nov-25 beans jumped out to a fresh 2-month with next resistance is at the June high of $10.74 ¼. Sept-25 oil jumped to a new high for the month with next resistance at the July high at 57.64. For now Sept-25 meal rejected trade back above $300 ton. The EPA ruled on 175 petitions (of the roughly 200) seeking relief from the nation’s RFS. Of those petitions considered 63 were granted full exemptions, 77 received partial exemptions (50%), 28 were denied while 7 were determined to be ineligible. The EPA added that refiners that were approved for exemptions had complied with the law and will have RIN credits returned, however credits returned from before 2023 will not be eligible for future compliance obligations. The EPA will return 1.39 bil. in credits for 2023 and 2024 that can be used for future compliance with total exemptions amounting to 5.34 bil. RINS. The EPA will seek public comment on whether larger refiners should make up for the exempted gallons. Still much uncertainty as big oil will surely challenge in court any reallocation effort by the EPA. Spot board crush margins surged another $.11 today to $2.19 ½ bu., a 2 week high, while bean oil PV improved to 48%. While remaining doubtful small refineries experience disproportionate economic hardship due to the RFS they announced they were pleased the EPA was taking a “reasonable approach to the SRE backlog”. Pro Farmer estimates the 2025 soybean crop at 4.246 bil. bu., 46 mil. below the USDA. Their Ave. yield forecast at 53.0 bpa, is still a record high, however below the USDA est. of 53.6 bpa.

WHEAT

Prices ranged from steady in MIAX to down $.05 in KC. Prices were slightly lower for all 3 classes for the week. Spreads leaned slightly lower in KC and CGO. Ukraine has so far harvested 27.25 mmt of grain which includes 21 mmt of wheat. Of this volume roughly half is considered to be of milling quality with 1.7 mmt of the milling wheat being allocated for domestic bread production. Russia Ag. Ministry has reinstated an export tax on wheat, raising it to 32.1 roubles/mt for the period ending Sept. 2nd. Still awaiting for progress on a Putin/Zelensky peace summit and clarity on security guarantees or the potential for tougher US sanctions on Russia. Slightly higher production forecasts from Russia may loosen up global stocks as it has weighed on global FOB offerings. Heavy rains for the S. plains next week to recharge subsoil moisture ahead of fall plantings likely the reason for KC sliding back below spot CGO futures despite the strong HRW exports.

Charts provided by QST.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.