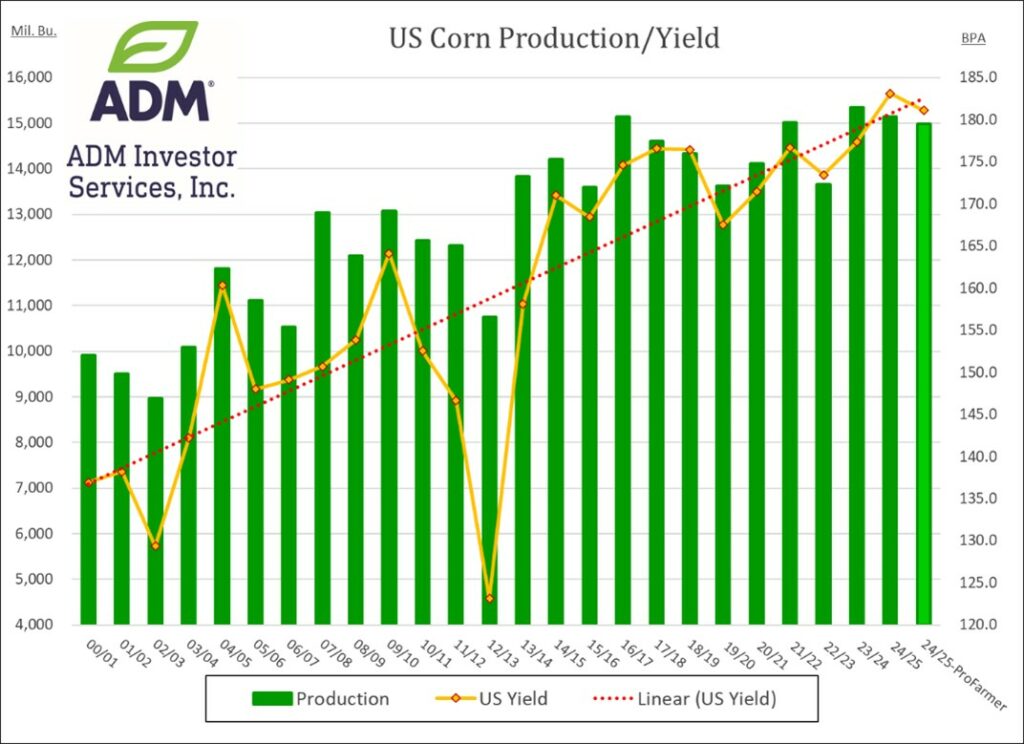

CORN

Prices were $.02-$.04 lower with new contract lows for spot Sept-24. New lows for the Sept/Dec spread as well trading out to $.23 ½. Dec-24 managed to hold above its contract low at $3.90. Not even a sharply lower US $$$ could help corn rebound. The dollar was sharply lower testing the late Dec-23 low following comments from Fed Chair Powell that “the time has come for policy to adjust”. The Pro Farmer crop tour estimates this year’s corn crop at 14.979 bil. bu. with an average yield of 181.1 bpa.

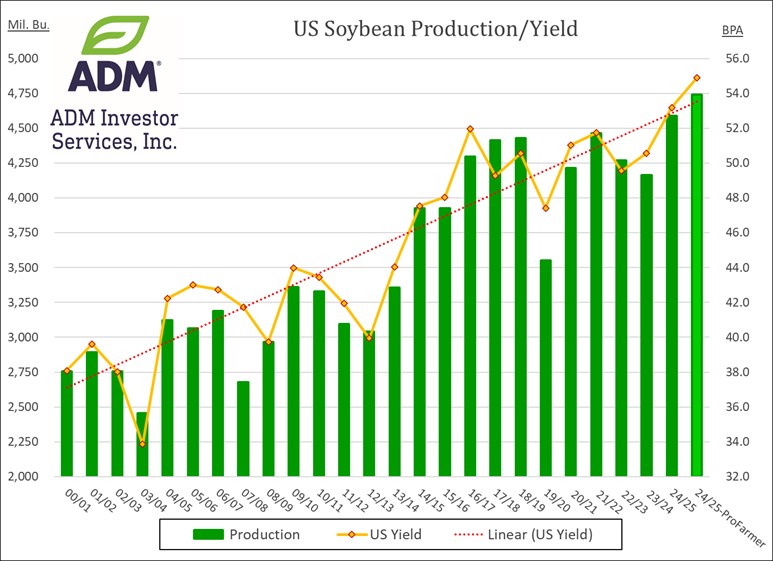

SOYBEANS

The soybean complex was mixed with beans $.10-$.12 higher, meal was steady, while oil was up 100 – 140. Inside trade for Nov-24 beans with support at the contract low at $9.55. Resistance at this week’s high of $9.85. Support for Sept-24 meal is at $300 with resistance at this week’s high of $317.70. After an outside day down yesterday, Sept-24 oil was sharply higher, however failed to form an outside day up. Strength likely being fueled by higher energy prices and chatter that Brazil is importing BO from Argentina to supply their growing renewable diesel production. Spot board crush margins were steady with bean oil PV trading back above 40%. The entire Midwest is expecting much above normal temperatures this weekend and into early next week. Mid to upper 90’s will be common in E. NE and W. IA Sunday thru Tues. Lower to mid-90’s for the central and ECB. Temperatures are expected to cool to more seasonal level by late next week for the northern half of the Midwest. Only scattered rains are expected over the NW half of the corn belt over the next 5 days. Better prospects for rain late next week with the expected cooling. Extending forecasts suggest cooler temperatures and better prospects for rain for the first week of September. The USDA announced the sale of 120k mt (4.4 mil. bu.) of soybeans to an unknown buyer. This brings accumulated announced sales this week to just over 51 mil. bu. The Pro Farmer crop tour estimates this years soybean crop at 4.740 bil. bu. with an average yield of 54.9 bpa, well above the Aug-24 USDA record forecast of 4.589 bil. and yield at 53.2 bpa.

WHEAT

Prices were lower across all 3 classes today settling on or near session lows. New contract lows for the Sept-24 contract all around. Chicago was down $.07-$.09 however Sept-24 is still holding above $5.00. KC was $.09-$.10 lower, while MGEX was down $.10-$.16. Markets likely bracing for higher US production at the end of Sept while trying to discourage new winter acres when plantings start next month.

Charts provided by QST Charts.

>>See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.