Soybeans and soyoil traded higher. Soymeal and corn traded unchanged. Wheat traded sharply lower. US stocks were higher. US Dollar was lower. Crude was higher. Gold was lower. Hogs were sharply higher.

SOYBEANS

Soybeans traded higher but off overnight highs. Trade is searching for bullish news to trade over 12.00 resistance. South America weather remains an important factor. Over the weekend. Brazil saw .1-1.00 inches of rain in central areas. MGDS missed the rains. Central and South Brazil could see good rains. Some estimate Brazil soybean crop near 128 mmt versus USDA 133. Abiove est the Brazil crop near 127 mmt. Argentina saw .5 inches over 50 pct of the area. Most of Argentina could be dry until Dec 24. Lower 2021 SA crops could add to US exports and lower US 2020/21 soybean carryout Weekly US soybean export were near 87 mil bu versus 48 mil bu ly. Last week’s exports were revised up to 95.0 mil bu. Season to date exports are near 1,178 mil bu vs 686 ly. USDA goal is 2,200 mil bu vs 1,676 mil bu. Some feel final exports could be closer to 2,375 mil bu.

CORN

Corn futures ended unchanged. CH tested the 20 day moving average but failed to trade over. This remains key resistance. Trade needs to see new bullish news to trade over resistance. The fact corn cannot trade over resistance limits new buying. US cash basis remain strong. Talk of lower South America and Ukraine crops that could increase US export demand could lower US carryout. This could be the necessary new to finally push nearby corn over resistance. Some feel final 2021 SA corn crops will be 375 mil bu below USDA latest guess. Some feel CH could eventually test 4.50-4.60. Weekly US corn export were near 35 mil bu versus 27 mil bu last year. Season to date exports are near 470 mil bu vs 285 ly. USDA goal is 2,650 mil bu vs 1,778 mil bu last year. Some feel final exports could be closer to 2,900 mil bu. Same story in corn as soybeans. Some look for lower SA and Black Sea supplies helping to increase US corn export demand. Some feel that a vaccine in 2021 could help restore demand for food, fuel and feed. There is also a large amount of potential new investment funds to buy commodities if demand increases. Some still feels 2021 corn prices need to trade higher for US farmers to increase 2021 acres to satisfy demand.

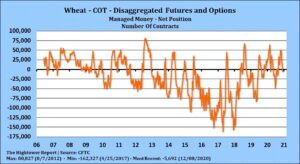

WHEAT

Wheat futures traded sharply lower. On again off again Russia news was off again today. Last week, news that Russia will soon announce and wheat export tax over the quota of 17.5 mmt offered support. Fact they could still ship 8 mmt to get their total to 38 mmt weighed on prices. Still some feel 2021 Russia crop could drop to 72 mmt versus USDA 84. A crop that low could force Russia to reduce exports for 2021. So far, talk of lower 2021 Russia crop has not yet increase demand for US wheat. Weekly US wheat export were near only 9 mil bu versus 18 mil bu ly. Season to date exports are near 504 mil bu vs 498 ly. USDA goal is 985 mil bu vs 965 mil bu. Chicago March wheat futures rejected last week’s high. 6.20 is key resistance. WH traded back below the 50 day moving average and is near the 20 day moving average support. Some feel that a vaccine in 2021 could help restore demand for food, fuel and feed. There is also a large amount of potential new investment funds to buy commodities if demand increases.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.