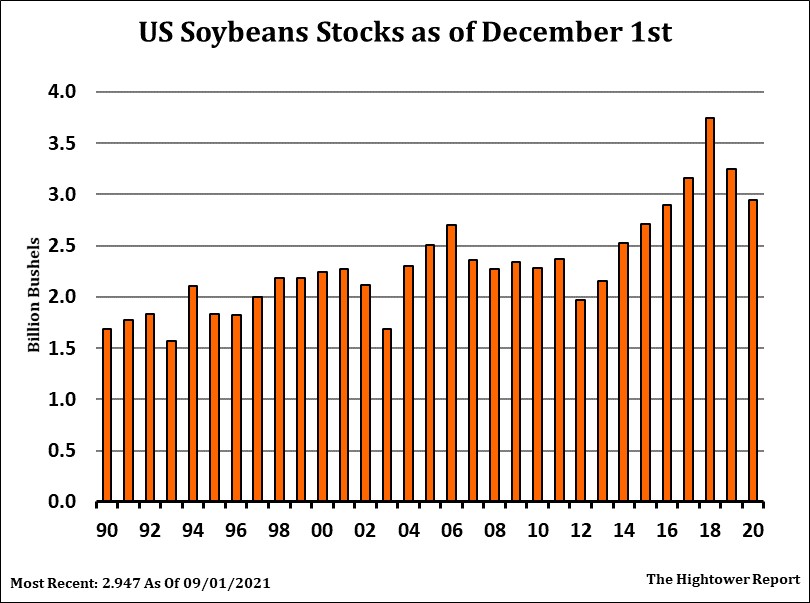

SOYBEANS

Soybean ended unchanged. Soybean futures are on hold until more is known about the South America weather. Noon maps reduced rains for parts of South Brazil. Argentina is expected to miss most of the needed rains. On Monday, SH could be up 10-15 cents if weekend rains are less than expected or down 10-15 cents if the dry areas get some needed rains. Some have lowered their estimate of South America soybean crop to closer to 195-196 mmt or down 7-8 from USDA. Weekly US soybean exports sales are estimated near 700-1,200 mt vs 811 last week. Weekly soymeal sales are estimated near 100-300 mt vs 300 last week. Soyoil sales are estimated at 10-30 mt versus 109 last week. US soybean export commit is near 41 mmt vs 54 ly. USDA goal is 56 mmt vs 62 ly. USDA est US 2021/22 carryout near 9.2 mmt vs 6.9 ly. Some are closer to 10.9.

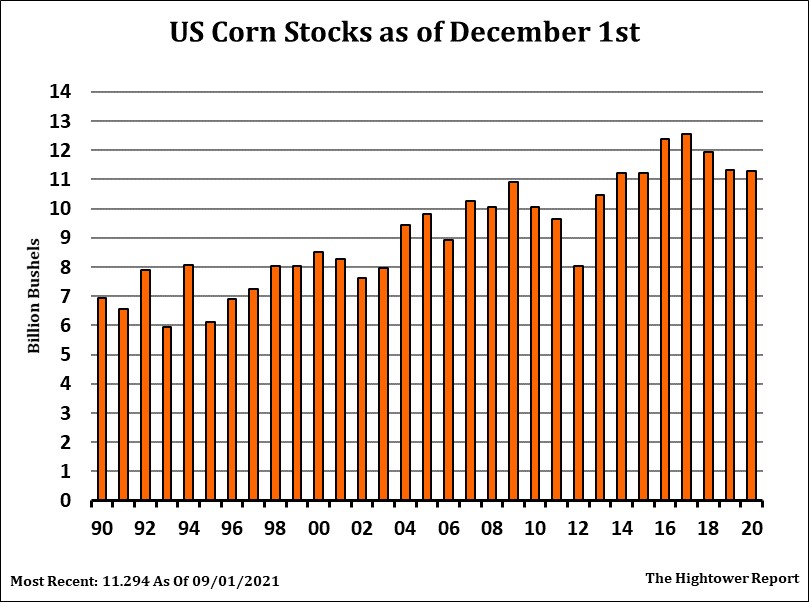

CORN

Corn futures is trying to find support from recent selloff. Corn futures are drifting near important support. On Monday, CH could be 5-7 higher if South America rains are less than expected and 5-7 lower if the dry areas get rain. Weekly US ethanol production was up 13 pct from last year. Stocks were down 12 pct from last year. Margins remain positive but down from the November high. Most still feel USDA may be 100-150 mil bu too low in their estimate of corn used for ethanol. Weekly US corn export sales are estimated at 500-1,100 mt vs 982 last week. Total commit is near 39 mmt vs 42 last year. USDA goal is 63 mmt vs 70 last year. Interesting to note that China has imported a record $100 billion dollars of food imports in 2020. They own 70 pct of World corn end stocks. Some feel they are stockpiling food in case their economy worsens. USDA est US 2021/22 corn end stocks near 38 mmt vs 31 last year. Range of trade guesses is from 32 mmt to 38. Some could see USDA raise US 2021 corn crop 7 mmt. Key then will be demand especially if they raise feed use due to higher supply. Trade will also be watching Dec 1 stocks. Some est US Dec 1 corn stocks near 302 mmt vs 282 ly.

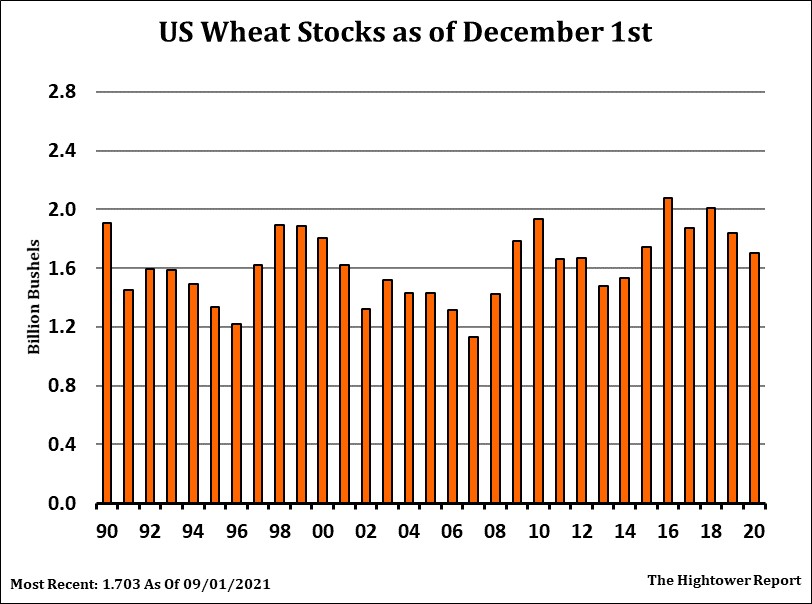

WHEAT

Wheat futures ended higher. Wheat is trying to find support. Egypt bought French, Ukraine and Romanian wheat but not Russia. Feb Russia export tax could be near $100. There was talk that Russia may sale wheat to China and Algeria. Some feel Russia wheat does not work to China. There was also talk that Iraq delayed a tender for option wheat. Some had thought Iraq might buy US but Canada, Argentina and Australia could be cheaper. Weekly US wheat export sales are est near 200-500 mt vs 425 last week. Total commit is near 15.6 mmt vs 20.0 last year. USDA goal is 16.2 mmt vs 23.0 ly. Interesting to note that China has imported a record $100 billion dollars of food imports in 2020. They own a record 51 pct of World wheat end stocks. WH ended near 7.87. Range was 7.74-7.93. 20 day moving average is 7.91. KWH ended near 8.25. Range was 8.11-8.29. KWH is back above 8.16 and 8.25 resistance. MWH slipped below 10.00 support. Range since late Oct has been 10.00-10.50. Resistance is 10.20 and 10.23. Low US export pace negative. Increase US farmer selling in 2022 also negative. Dry US south plains weather now focus and less last years lower US and Canada spring wheat crops.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.