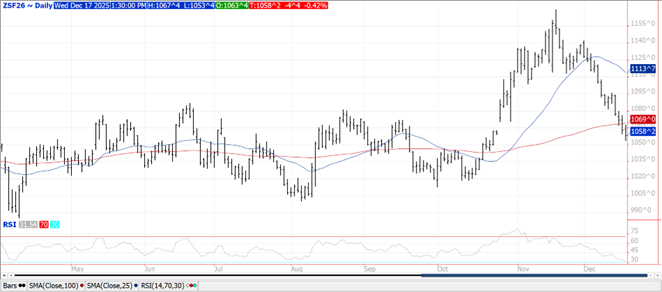

CORN

Prices were $.01-$.04 higher as corn was able to separate from weakness in the soy complex. Spreads also firmed. Mch-26 close back above its 100 day MA and above yesterday’s high. The $4.35-$4.55 range remains intact. The USDA announced the sale of 177k mt (7 mil. bu.) of corn to Mexico. Ethanol production jumped to 332.5 mil. gallons LW, up from 325 mil. the previous week and a new all-time high. Production was well above expectations and above the pace needed to reach the USDA corn usage forecast of 5.60 bil. bu. Despite the higher than expected production, ethanol stocks slipped to 22.4 mil. barrels, below expectations at below the 22.6 mb from YA. Implied gasoline usage surged 7.4% to 9.078 mbd, and was up 1.7% YOY. COF after the close on Friday is expected to show cattle inventories down 1.7% from YA, as they continue to hold 1-2% below last year. Despite this the USDA feed usage forecast of 6.1 bil. bu. is up 11.6% from YA. A South Korean feed group reportedly bought 268k mt of feed corn around $254/mt CF.

SOYBEANS

Prices were mostly across the complex with beans off $.03-$.05, meal was down $4-$5 while oil rebounded to close 15 points higher. Bean spreads weakened while product spreads were steady to firm. Fresh 8 week low for Jan-26 beans with next support near $10.20. Jan-26 meal has also plunged to a fresh 8 week low, rejecting early strength. Next support is at its 100 day MA at $297.70. Jan-26 oil bounced after reaching a 6 month low in early trade. Spot board crush margins slipped $.03 to $1.31 ½ bu. with bean oil PV rebounding to 44.9%. The USDA announced the sale of 198k mt (7.3 mil. bu.) of beans to China and 125k mt (4.6 mil.) to an unknown buyer. China will be auctioning off another 550k mt of soybean on Friday as they work to free up 4 mmt of storage space for the arrival of US purchases. Chinese purchases will likely not be enough to keep the USDA from lowering their export forecast at least 30-50 mil. bu. in the Jan-26 WASDE. Also contributing to the recent price slide is the continued delays from the Trump Admin. on biofuel blending mandates for 2026 and 2027 as the EPA has pushed back this decision into Q1 of next year.

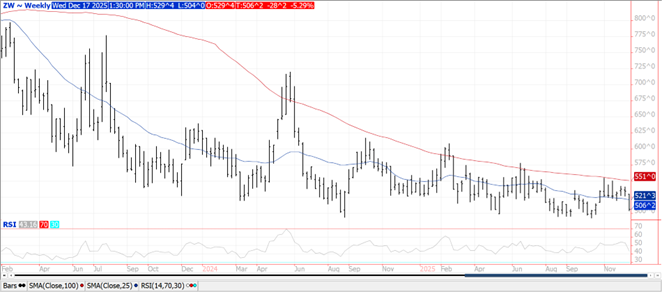

WHEAT

Prices ranged from $.03 lower in CGO and MIAX to $.03 higher in KC. Spreads have also weakened in CGO while steady to firm in KC. New contract lows for spot CGO and MIAX. The USDA confirmed the cancellation of 132k mt of white wheat sold to China. That sale held on the books for not even a month. While the USDA will likely show a reduction in US winter wheat acres next month, it has done little to support prices in the face of rising global production and stocks. Question becomes, how low is low. Support for Mch-26 CGO is at $4.92, the fall low on the spot weekly chart. CGO Mch-26 spread over corn has fallen to a new low of $.66 bu. as it tries to work into feed rations. Mch-26 KC rests just above its contract low at $4.98 ¾. Expectations for expanded drought reading across the US southern plains in tomorrow’s US drought monitor update likely the cause for support in KC futures.

Charts provided by QST.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.