CORN

Prices were $.04 – $.06 lower today. Today was the 6th consecutive session of contract lows in Mch-24 and 10 of the past 11. Psychological support is at $4.00, vs. today’s low at $4.04 ¼. New crop Dec-24 traded to a 2 ½ year low, however held above $4.50. The USDA did announce the sale of 126k mt of sorghum to China. Ethanol production ticked up to 1,084 tbd last week, up from 1,083 tbd the previous week and up 5% from YA. Production was slightly above expectations and above the pace needed to reach the USDA corn usage forecast of 5.375 bil. There was 108.6 mil. bu. of corn used in the production process, or 15.5 mil. bu. per day, above the 14.6 mbd needed to reach the USDA forecast. The Rosario Grain Exchange lowered their Argentine production forecast 2 mmt to 57 mmt, still above the USDA forecast of 55 mmt. The BAGE reports corn conditions improved 1% in both G/E and fair, with a 2% drop in poor/VP. They maintained their production forecast at 56.5 mmt. Export sales tomorrow are expected to range from 28 – 52 mil. bu.

SOYBEANS

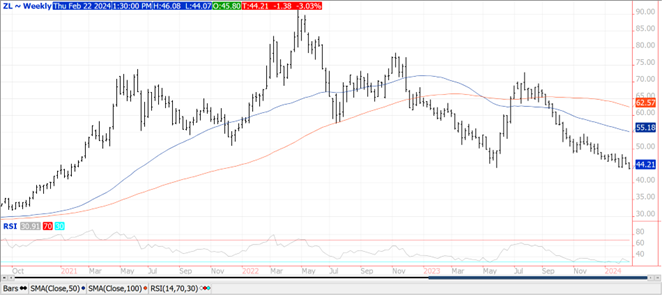

The soybean complex was lower across the board with beans down $.11 – $.13, meal was $4 – $7 lower, while oil was down 40 – 60. Mch-24 beans slipped to a new 9 month low and barely held above the contract low from last May at $11.45 ¼. New contract low for Mch-24 meal, next support on the weekly chart is at $323. New contract low for Mch-24 oil while the lowest level on the weekly chart in 3 years. Overall conditions in South America remain favorable with a good mix of rain and sunshine over the next week to 10 days. Southern and SW areas of Brazil will see scattered rains thru the weekend with net drying expected, favorable for soybean harvest and finishing up 2nd corn plantings. Better rains are expected early next week which will be needed to maintain favorable crop development. Spot board crush margins fell nearly $.10 today to $.75 bu. The Rosario Grain Exchange lowered their Argentine production forecast 2.5 mmt to 49.5 mmt, now just below the USDA forecast of 50 mmt. The BAGE reports bean conditions held steady at 31% G/E, however there was a 2% shift from poor/VP to fair. They maintained their production forecast at 52.5 mmt. Export sales tomorrow are expected to range from 12 – 28 mil. bu. for beans, 150 – 400k tons meal and -5 – 10k tons oil.

WHEAT

Prices were mixed with Chicago steady to higher, while MGEX was $.05 – $.08 lower and KC down $.02 – $.03. Mch-24 Chicago peaked right at $6.00, just below the 50 day MA at $6.00 ½, and the 100 day MA at $6.02 ¼. While the Mch/May CGO spread backed off a touch today, it remains at a $.04 inverse as exporters struggle to acquire SRW wheat to fill Chinese purchases from December. At the high today, Mch-24 CGO traded $1.85 over Mch-24 corn, the highest since last August. Temperatures are expected to remain in an above normal trend for the eastern two thirds of the US into early March. Rain over the next 7 days is expected to favor the ECB. Little to no moisture for the US plains and WCB. Wheat has been supported this week as the Biden Administration considers further economic sanctions on Russia following the death of Putin critic Alexei Navalny in a Russian prison last week. Spring wheat areas in drought increased 6% last week to 28%, still well below the 64% from YA. Japan’s Ag. Ministry bought a combined 116k mt of Australian, Canadian and US wheat. The lowest price offered for Bangladesh’s recent 50k mt tender was just under $280/mt CF, likely Russian. South Korea and Tunisia are also seeking wheat in tenders that close tomorrow.

All charts provided by QST

>>See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.