SOYBEANS

Soybeans traded higher. Talk of concern about Brazil and Argentina 2021 crops offered support. New technical buying rallied prices over 14.00 SK. Some look for soybean prices to be in for more of a roller coaster ride now. Prices could be supported into USDA March 9 supply and demand report and March 31 acreage and stocks report. Prices could then find resistance if US 2021 planting season is normal and South America improves on exports. Then prices could begin to add some premium into US summer growing season. Need for US farmers to plant 90 million soybean acres and a near record yield to get a US 2021/22 carryout near USDA 145 could support prices. Brazil soybean harvest Is near 15 pct done with concern about early yields and disease. Higher highs in China vegoil contracts and Malaysian palmoil futures pushed BOK over 48 cents. Talk that EPA may not offer waivers to refiners for biofuels also supported prices.

May soybean futures chart

CORN

Corn futures futures closed mixed. CK closed near 5.52 and in the Midpoint of the daily range between 5.49 and 5.59. CZ closed unchanged and near 4.69. Some of the buying was following sharply higher soybean, soymeal and soyoil prices. Lower Wheat prices offered resistance. Talk that Brazil corn crop was 15 pct planted versus 50 last year offered support. Fact Matif corn futures have been higher and making new highs for the last 6 days also offered support. There is also talk of a potential squeeze on the March contract also offered support. EU feedgrain supplies continue to decline. Some look for corn prices to be in for more of a roller coaster ride now. Prices could be supported into USDA March 9 supply and demand report and March 31 acreage and stocks report. Prices could then find resistance if US 2021 planting season is normal and South America improves on exports. Then prices could begin to add some premium into US summer growing season. Need for US farmers to plant 92 million corn acres and a near record yield to get a US 2021/22 carryout near USDA 1,552 could support prices.

December corn futures chart

WHEAT

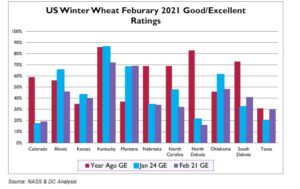

Wheat futures traded mixed. WK closed near 6.70 with a daily range between 6.61 and 6.72. KWK closed near 6.48 with a daily range between 6.40 and 6.52. Early selling was linked in part to fact Weekly USDA winter wheat crop ratings did not drop as much as feared. There ae also forecast that over the next week USA south plains could see close to normal rains. This could help the crop that was stressed by last weeks record cold temps. Concern about EU and Russia wheat supply offer support. March Matif wheat futures have traded higher. There is talk that there could be a squeeze on the March contract with lower delivered stocks versus open interest. There are also no new crop Russia wheat offers. Some look for Russia 2020/21 exports to be near 34 vs USDA 39.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.