Soybeans, soymeal, soyoil and corn ended lower. Wheat traded higher.US Dollar was lower. US stocks were higher. Crude was higher. Gold was higher. US stimulus is helping US stocks. Vaccines are helping Crude and stocks. Higher US debt is weighing on US Dollar.

SOYBEANS

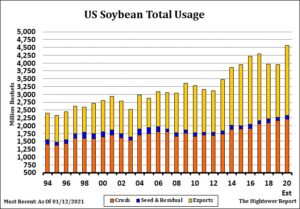

US soybean futures ended lower. For the first week in Feb, soybean futures were down 22 cents, soymeal down $6 and soyoil down 148 points. Good weekly US soybean export sales, talk of tighter US soybean balance sheet and delays in Brazil soybean vessel loadings failed to attract new buying. Fact China may be slowing new old crop soybean buying and is now focusing on Brazil and new crop helped SX21 gain on SH. Farm Futures magazine surveyed 806 farmers and estimated US 2021 soybean acres near 84.5. Most look soybean acres near 90.0. Stats Canada estimated Dec 31 canola stocks near 12.0 with 10.3 on farm. Stocks were below expectations. Next USDA report is Feb 9. Trade estimates US 2020/21 soybean carryout near 123 mil bu versus USDA 140. Trade estimates Argentina soybean crop near 47.6 mmt versus USDA 48.0. Brazil crop is estimated near 132.4 versus USDA 133.0.

CORN

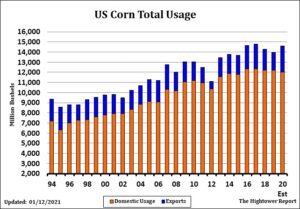

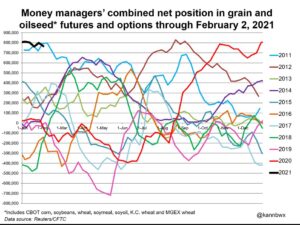

Corn futures ended mixed. CH was down 1 cent while CZ21 was unchanged. For the week CH was down 12 cents. Record US weekly corn export sales, Talk of tighter US 2020/21 corn balance sheet and late Brazil corn plantings failed to attract new buying. Funds remain large corn longs. Question is will they hold those longs after the USDA report, into South America harvest and into US spring planting season. Farm Futures magazine surveyed 806 farmers and estimated US 2021 corn acres near 94.7 million. Most look corn acres near 93.0. Stats Canada estimated Dec 31 barley stocks near 5.7 with 5.2 in farm. Stocks were below expectations. Next USDA report is Feb 9. Trade estimates US 2020/21 corn carryout near 1,392 mil bu versus USDA 1,552. Pro Farmer estimates US 2020/21 corn carryout at 1,350. They estimate 2021 US corn acres at 93.0, yield at 179 which would produce a crop near 15,300 mil bu. They estimate total demand near 15,000 which suggest a carryout near 1,700. Trade estimates Argentina corn crop near 47.0 mmt versus USDA 47.5. Brazil crop is estimated near 108.4 versus USDA 109.0.

WHEAT

Wheat futures ended higher. Lower US Dollar may have offered support. WH Was down 17 cents this week. This linked to uncertainty over new Russia export policy and lower Russia wheat prices. Lower Russia wheat prices due to increase farmer selling before export taxes or new policy raises export prices and lowers exports. EU wheat export pace should slow. Farm Futures magazine surveyed 806 farmers and estimated US 2021 wheat acres near 46.0 with spring acres near 12.6. Most estimate wheat acres near 45.0. Stats Canada estimated Dec 31 wheat stocks at 24.8 with 21.0 on farm. Stocks were below expectations. Next USDA report is Feb 9. Trade estimates US 2020/21 wheat carryout near 834 mil bu versus USDA 836. Trade also estimates World wheat carryout near 312.8 mmt versus USDA 313.1.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.