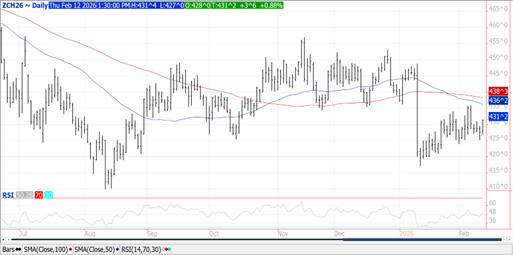

CORN

Prices were $.03 ½ – $.05 ½ higher, closing at session highs. Spreads weakened however. Next resistance for Mch-26 is this month’s high at $4.36. Prices remain rangebound between $4.15-$4.40. Yesterday’s EPA data showed ethanol production rebounding to 326 mil. gallons, up 2.6% YOY and above the pace needed to reach the USDA usage forecast of 5.60 bil. bu. Conab lowered their Brazilian production forecast .5 mmt to 138.45 mmt, still well above the USDA forecast of 131 mmt. The 2nd crop was trimmed 1.2 to 109.26 mmt due to reduced acres. The Rosario Board of Trade kept their Argentine production forecast unchanged at 62 mmt, well above the USDA est. of 53 mmt. Export sales at 82 mil. bu. were above expectations. YTD commitments at 2.394 bil. bu. are up 31% from YA, vs. the revised USDA forecast of up 15.5%. Noted buyers were Japan – 24 mil., Korea – 13 mil., Colombia – 11 mil. and Mexico – 8 mil. US corn acres in drought rose 2% to 31%.

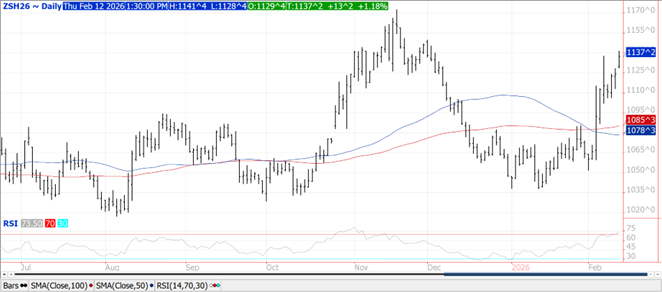

SOYBEANS

Prices were higher across the complex with beans up $.06-$.13 led by old crop futures. Meal was $2-$5 higher while oil was up 30-50 points. Spreads strengthened all around. Fresh 2 ½ month high for Mch-26 soybeans with next resistance at the Dec-26 high just below $11.50. New contract high for Mch-26 oil while so far holding just below the Aug-25 high at $.58 lb. on the spot weekly chart. Mch-26 meal traded to a 7 week high. Reports from Chinese media that Pres. Trump and Chinese leader Xi would meet in Beijing in April helped stimulate higher trade across the Ag. space today. Spot board crush margins improved $.03 to $1.73 bu. with bean oil PV slipping to 48.3%. Conab raised their production forecast nearly 2 mmt to 178 mmt, still below the USDA est. of 180 with many private forecasts in the mid 180’s. Higher yields more than offset slightly lower acres. The RBOT raised their Argentine production forecast 1 mmt to 48 mmt while citing anticipated rains over the next 2 weeks will be critical for crop development. Brazilian FOB offers remain $.80-$1.00 below US Gulf thru May. Export sales at 10 mil. were at the low end of expectations. YTD commitments at 1.270 bil. are down 20% from YA vs. the USDA forecast of down 16%. Sales to China at 286k mt (most switched from unknown) bring total commitments to 10.2 mmt with another 2.74 mmt left to unknown. Shipments to China are early 5.1 mmt. The USDA reported a flash sale of 108k my (4 mil. bu.) to Egypt. Meal sales at 357k tons brought YTD commitments to 10,001k tons up 9% YOY vs. the USDA forecast of up 5%. Bean oil commitments at 746 mil. lbs. are down 50% YOY in line with the USDA forecast. Chinese crush margins from imported soybeans remain positive only for imports from Brazil. US soybean acres in drought increased 3% to 37%.

WHEAT

Prices ranged from $.07-$.15 higher with CGO and KC the upside leaders. All 3 classes closed near session highs. Spreads also firmed. CGO Mch-26 traded to its highest level in nearly 3 months. CGO Mch-26 spread to Mch-26 corn surged to just over $1.20 bu., the highest since Aug-25. KC Mch-26 surged to a 6 month high. Conab lowered their production forecast 1 mmt to 6.9 mmt, well below the USDA est. of 8 mmt. Export sales at 18 mil. bu. were at the high end of expectations bringing YTD commitments to 820 mil. bu. up 17% from YA, vs. the USDA forecast of up 9%. By class commitments vs. USDA forecast are HRW +76% vs. USDA +49%, SRW steady vs. -2%, HRS down 7% vs. -8%, and white down 2% vs. – 6%. Some have attributed recent strength to potential production issues with Russia’s winter crop due to severe cold and icing. Probably weeks before potential damage can be assessed. US winter wheat areas in drought jumped 2% to 45% matching its 52 week high.

Charts provided by CQG

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.