Soybeans, soymeal, soyoil, corn and wheat traded higher. Fact China bought US corn and could continue to buy US corn and soybeans helped push prices higher. Nearby futures gained on new crop due to tightening US corn and soybean balance sheets. US Dollar was lower.

SOYBEANS

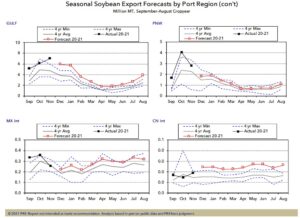

SH is traded over the 20 day moving average of 13.50. Trade back above 13.78 could offer a positive picture to what was a negative chart formation last week. Bull still talking about 15.00+ soybean futures. There continues to be talk that Brazil harvest could be delayed and that China may be asking for US Feb prices. Some feel there could be as much as 5 mmt of Brazil soybean sales that could be switched to US. New US corn sales to China offered support to soybean prices. Key to price direction in 2021 may depend upon US planted acres, weather/yield and final demand. Weather watchers still trying to figure out 2021 north hemisphere weather. USDA next supply and demand report is Feb 9. Can’t get here fast enough. USDA annual Outlook conference is Feb 18-19. This will be their first look at US 2021/22 supply and demand. US farmer has sold most of his 2020 soybean crop supplies.

CORN

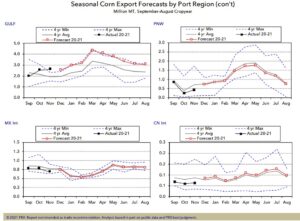

CH traded back above 5.20 resistance. Momentum has turned higher and could suggest CH could make new highs. Some feel CH may need to trade closer to 6.00 to slow demand. USDA announced China bought 1.36 mmt US corn. Some feel they could buy another 6.5 mmt due to lower supplies and increase demand. Most feel US 2021 corn acres may need to be near 93.0, yield of 181.0, crop of 15,390 to increase US 2021/22 carryout to near 1,215. There were rumors that China may have been an active buyer of US ethanol. Key to price direction in 2021 may depend upon US planted acres, weather/yield and final demand. Weather watchers still trying to figure out 2021 north hemisphere weather. USDA next supply and demand report is Feb 9. Can’t get here fast enough. USDA annual Outlook conference is Feb 18-19. This will be their first look at US 2021/22 supply and demand. US farmer has sold most of his 2020 corn crop supplies. South America and Black Sea farmers are slow sellers of now crop due to weather uncertainty and looking for higher prices. One crop scout estimated Brazil corn crop near 105 mmt versus USDA 109 and Argentina 44.5 versus USDA 47.5.

WHEAT

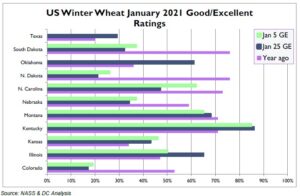

WH is traded over initial resistance near 6.64. Momentum has turned higher. Some feel wheat is following corn. Uncertainty over Russia exports as export taxes go up and talk of lower EU supplies could help wheat futures. Some estimate US 2021 all wheat crop near 1,860 mil bu with carryout near 735. Key will be weather and if yields reach that high. Talk of strengthening La Nina could increase chances for warmer and drier than normal US and Russia spring and summer. USDA dropped US HRW crop ratings from last month and raised SRW. Key to price direction in 2021 may depend upon US planted acres, weather/yield and final demand. Weather watchers still trying to figure out 2021 north hemisphere weather. USDA next supply and demand report is Feb 9. Can’t get here fast enough. USDA annual Outlook conference is Feb 18-19. This will be their first look at US 2021/22 supply and demand.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.