CORN

Prices were $.01-$.02 higher with spreads also firming. For now Mch-26 seems to have run out of sellers below $4.20. Next support is at the contract low at $4.10. The USDA did report a flash sale of 136k mt (5.4 mil. bu.) to S. Korea. Ethanol production surged to 1,196 tbd, or 352 mil. gallons in the week ended Fri. Jan. 9th, a new all-time high. Production was up 9% vs. YA. There was 119 mil. bu. used in the production process, or 16.9 mil. bu. per day, well above the 15.3 mbd needed to reach the USDA forecast of 5.60 bil. bu. In the MY to date there has been 2.020 bil. bu. used, or 15.4 mbd, an annualized pace of 5.628 bil. Ethanol stocks jumped to 24.5 mil. barrels, a 5 month high however just below the 25 mb from YA. Production margins did slump in the past week so unlikely this torrid pace will hold up for long. Tomorrow’s export sales are expected land between 25-55 mil. bu.

SOYBEANS

Prices were mixed with beans up $.03-$.06, meal is $1 higher while oil is steady to 10 points lower. Bean spreads have firmed while product spreads are weaker. Inside trade for Mch-26 beans which for now has rejected trade into fresh 3 month lows yesterday. Also inside trade for Mch-26 meal. Mch-26 oil stretched out to a fresh 4 week high before pulling back to its 100 day MA near 51.24. Board crush margins slipped $.05 ½ today to $1.60 ½ per bu. while bean oil PV ticked down to 46.6%. The USDA announced a flash sale of 334k mt (12.2 mil. bu.) of soybeans to China. Chinese customs data showed they imported 8.044 mmt of beans from all sources in Dec-25 up 1.2% from Dec-24. Total imports in 2025 at 111.8 mmt were up 6.5%. Total purchases from the US for the 25/26 MY are believed to be between 10-11 mmt, nearing the 12 mmt total. Chinese demand to shift to SA once this level is reached as their FOB offers are roughly 60 cents below US into the Spring. Dec-25 NOPA crush at 11 AM CST tomorrow is expected to reach nearly 225 mil. bu. vs. 206.6 from Dec-24 and if realized would be the 2nd highest figure ever reported. Bean oil stocks are expected to rise 11.4% from Nov-25 to 1.686 bil. lbs. Tomorrow’s export sales are expected range between 30-65 mil. bu. for beans, 0-25k tons of oil and 150-400k tons of meal.

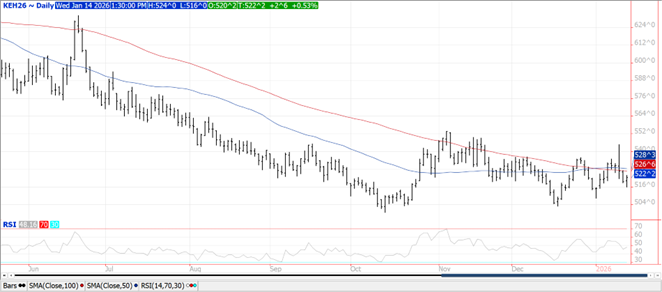

WHEAT

Prices were $.01-$.03 higher across the 3 classes in quiet 2 sided trade. Spreads firmed in both CGO and KC. Mch-26 CGO has fallen back into a $5.00-$5.25 range. Mch-26 KC is hovering just below MA resistance near $5.27. IKAR earlier this week raised their Russian wheat export forecast 2.4 mmt for the 25/26 MY to 46.5 mmt. The USDA held their forecast unchanged at 44 mmt. SovEcon expects Russia to export 3 – 3.4 mmt of wheat in Jan-26, up from 2.3 mmt in Jan-25. They raised their 25/26 MY export forecast to 44.6 mmt. Week 2 of the forecast has better prospects for rain in the US plains. Tomorrow’s export sales are expected to range between 5-15 mil. bu. With stocks among global exporters at a 10 year high while US stocks at a 6 year high I suspect and rally attempts will capped rather quickly.

Charts provided by CQG

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.