CORN

Prices finished mixed and within $.01 of unchanged. Spreads weakened. Mch-26 held within Friday’s range. Since last Monday’s USDA reports selling seems to dry up below $4.20 while buyers back away above $4.25. Friday’s CFTC data showed MM’s were net sellers of over 65k contracts of corn extending their short position to 82k contracts. Index funds however were net buyers of just over 20k contracts. Record ethanol production last week raises hopes for higher domestic usage. There is an increased push for the sale of E-15 year round with a new bill being introduced by NE republican Deb Fischer that would allow ethanol blends of up 15% ethanol by 2027. AgRural estimates Brazilian plantings at 1%. Export inspections at 58 mil. bu. were above expectations however just below the 61 mil. needed per week to reach the USDA forecast. YTD inspections at 1.178 bil. are up 56% from YA vs. the USDA forecast of up 12%. Mexico took 16 mil. bu. while Japan and Colombia took 10 mil. each and Korea took 8 mil. EU corn imports as of Jan. 15th at 9.2 mmt are down 19% YOY.

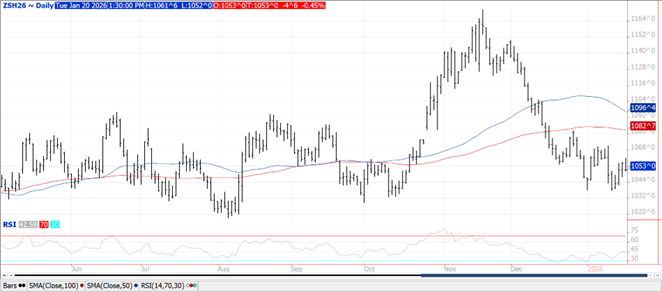

SOYBEANS

Prices were mostly lower with beans closing down $.05 near session lows, meal was steady to $1.50 higher while oil was down a modest 5 points. Bean and oil spreads were mixed and little changed while meal spreads firmed. Mch-26 beans rejected trade above last week’s high. Support is at last week’s low near $10.38. Mch-26 meal has bounced nicely off the 3 month lows established late last week. Inside trade for Mch-26 oil. Favorable weather in SA was partially offset by a sharp drop in the US $$$. President Trump threatened European countries that oppose the US purchase of Greenland with escalating tariffs. These tariffs would start at 10% on Feb. 1st and increase to 25% by June 1st. The EU is prepared to impose retaliatory tariffs of over $100 bil. on US imports which would likely include agricultural commodities. Spot board crush margins bounced back $.07 ½ to $1.66 ½ bu. while bean oil PV slipped back to 47.4%. MM’s were net sellers of nearly 45k contracts of soybeans, while buying 13.5k contracts of oil and 3.6k of meal. Index funds were moderate sellers across the entire complex. The USDA announced a flash sale of 190k mt of soybean meal to Philippines. AgRural estimates Brazil’s harvest has reached 2% as of Jan. 15th, slightly above the YA pace. Wire services are reporting China has reached their pledge to purchase 12 mmt of US soybeans with the first shipments expected to arrive this week. Export inspections at 49 mil. bu. were in line with expectations and above the 28 mil. bu. needed per week to reach the USDA forecast. YTD inspections at 710 mil. are down 40% from YA vs. the USDA forecast of down 13%. China took 22.5 mil. while Germany and Mexico took 4-5 mil. each. EU soybean imports as of Jan. 15th at 6.7 mmt are down 16% YOY. Meal imports at 9.9 mmt are down 10%.

WHEAT

The weakling within the Ag. space with prices down $.03-$.08 across the 3 classes. CGO Mch-26 traded below Friday’s range however holding within a $5.00-$5.25 range. KC Mch-26 is consolidating near its 50 and 100 day MA’s near $5.26. India’s plan to export at least 500k mt of wheat has weighed on valuations. Over the 3 day weekend Algeria bought 600k mt of milling wheat between $253-$254/mt CF for Feb/March shipment. Much is believed to have been sourced from Argentina. Saudi Arabia reportedly bought 900k met of wheat between $258-$265/mt CF for April/May shipment. The grain is likely all sourced from the Black Sea region. SovEcon reports Russian FOB prices ended last week between $226-$228/mt up from $225 the previous week. For the week ended Jan. 13th MM’s were modest buyers of CGO and KC wheat while a lite buyer of MIAX futures. Index funds were net buyers of both KC and CGO.

Charts provided by CQG

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.