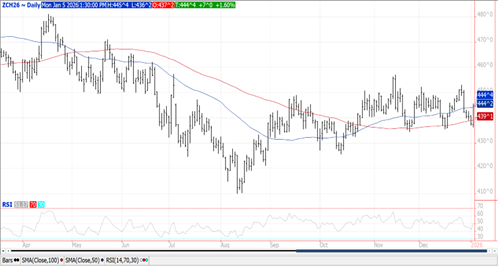

CORN

Prices were $.05-$.07 higher with spreads also firming. Mch-26 closed back above both its 50 and 100 day MA’s while still holding in a $4.35-$4.55 range. Corn used for ethanol slipped to 472 mil. bu. in Nov-25, in line with expectations. In Q1 of the 25/26 MY usage has reached 1.382 bil. bu. matching the YA, while the USDA forecast is for a 3% increase. Export sales at 30 mil. bu. were a MY low bringing YTD commitments to 1.990 bil. bu. up 30% from YA, vs. the USDA forecast of up 12%. YTD commitments represent 62% of the USDA forecast, above the historical average of 53%. Export inspections at 48 mil. bu. were a MY low however in line expectations and below the 61 mil. needed per week to reach the USDA forecast. YTD inspections at 1.056 bil. are up 65% from YA. Noted takers were Japan – 12 mil. and Mexico with 9 mil.

SOYBEANS

Higher trade across the complex was fueled by renewed Chinese interest in US soybeans. Sources suggest China may have secured up to 1 mmt of US beans for Spring shipment, perhaps seeking to complete their commitment to buy 12 mmt for the 25/26 MY ahead of next Monday’s USDA reports. Beans were up $.13-$.18, meal was $3-$4 higher while oil was up 55-60 points. Mch-26 beans clawed back above $10.60 ending a run of 5 consecutive lower closes. Mch-26 meal closed near Friday’s high at $300 per ton while oil tested the upper end of its $.48-$.50 range. Deliveries against Jan-26 soybean slipped to 401 contracts, oil dropped to zero while 20 deliveries against Jan-26 meal. Soybean exports at 43 mil. brought YTD commitments to 1.018 bil. down 31% from YA vs. the USDA forecast of down 13%. Commitments represent 62% of the USDA forecast, below the historical average of 75%. Sales to China at 396k tons (14.5 mil. bu.) for the week ended Dec. 25th brought announced sales to 6.4 mmt. Actual sales before today were likely closer to 8.5 mmt. Today’s rumored purchases would push sales between 9.5-10 mmt, just over 80% of the 12 mmt they have committed to buying. Meal sales at 111k tons brought YTD commitments to 8,895k tons up 7% YOY vs. the USDA export forecast of up 5%. Bean oil sales at 14 mil. lbs. bring YTD commitments to 582 mil. down 53% YOY vs. USDA down 64%. Soybean inspections at 36 mil. bu. were in line with expectations and above the 30 mil. bu. needed per week to reach the USDA forecast. YTD inspections at 603 mil. are down 45% from YA. China was the biggest taker with 14.5 mil. while Egypt took 7 mil.

WHEAT

Prices ranged from steady to $.06 higher across the 3 classes with KC and CGO futures the leaders to the upside. Mch-26 KC has 50 and 100 day MA resistance starting at $5.28. Mch-26 CGO continues to recover after holding support above $5.00 LW. Export sales at 3.5 mil. bu. bring YTD commitments to 735 mil. bu. up 18% from YA, vs. the USDA forecast of up 9%. Commitments represent 82% of the USDA forecast, above the historical average of 75%. By class commitments vs. the USDA forecast are: HRW up 83% vs. USDA up 49%, SRW up 7% vs. up 2.6%, HRS down 8% in line with USDA, and white up .5% vs. down 10%. Wheat inspections at 7 mil. bu. were below expectations and below the 16 mil. bu. needed per week to reach the USDA forecast. YTD inspections at 561 mil. bu. are up 20% from YA.

Charts provided by CQG

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.