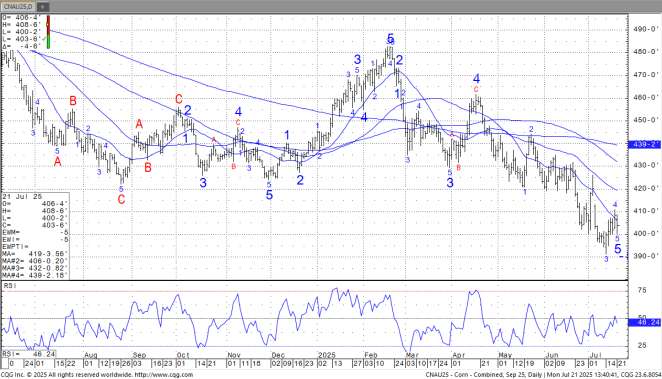

CORN

CU ended near 4.03. Weekly US corn exports were 983 mt and below the lower end of trade estimate. Total exports are near 58.8 mmt vs 45.6 ly. USDA goal is 69.8 mmt vs 57.2 ly. USDA estimates total World 2024/25 corn exports at 192.5 mmt vs 192.5 ly. USDA est China imports at 5.0 mmt vs 23.4 ly. USDA estimâtes Brazil 24/25 corn exports at 43.0 mmt vs 38.2 ly. This includes a Brazil crop est of 132 mmt vs 119 ly. USDA est Brazil 2025/26 corn crop at 131 mmt with some est closer to 134. US farmers remain reluctant sellers of new crop corn.

SOYBEANS

SU ended near 10.09. Soymeal is below 275. World soymeal basis levels are sharply lower on too much supply. Soyoil ended higher on talk of increase demand. Weekly US soybean exports were 364 mt and at the mid point of trade estimate. Total exports near 46.7 mmt vs 42.3 ly. USDA goal is 50.7 mmt vs 46.2 ly. USDA estimates total World 2024/25 soybean exports at 180.6 mmt vs 177.7 ly. USDA est China imports at 106.5 mmt vs 112.0 ly. June China soybean imports were 12.2 mmt or up 9 pct vs ly. China continues to buy Brazil soybeans. USDA est Brazil 24/25 soybean crop at 169 mmt with exports at 102.1. USDA est Brazil 25/26 soybean crop at 175 mmt with exports at 112.0 mmt. US farmers remain reluctant sellers of new crop soybeans.

WHEAT

WU ended near 5.42 in mostly range bound trade. Weekly US old crop wheat exports were up to 732 mt. Total exports are near 3.0 mmt vs 2.6 ly. USDA goal is 23.1 mmt vs 22.4 ly. USDA estimates total World 2025/26 wheat exports at 213.0 mmt vs 205.5 ly. Bangladesh signed trade deal for 700 mt of US wheat annually for next 5 years. Bangladesh normal buys Black Sea wheat wile buying 100-130 mt from US.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.