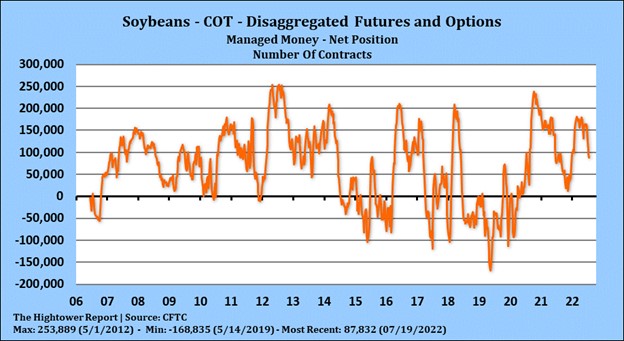

SOYBEANS

Soybeans ended higher. Some bought soybeans after 2 weeks US Midwest forecast calls for below normal rains and above normal temps. SU traded above Fridays high. Next resistance is 13.74. Weekly US soybean exports were 14 mil bu. Season to date exports are 1,947 vs 2,137 ly USDA goal is 2,170 vs 2,261 ly. USDA could drop exports 50 mil bu if China buying is less than hoped. C IL soybean basis dropping due to slow demand. US Midwest could turn warmer and drier next week. 2nd week also looks warm and dry. Some fear this could drop final US soybean yield from USDA 51.5. Trade expects USDA to rate the US crop 60 pct G/E vs 61 last week.

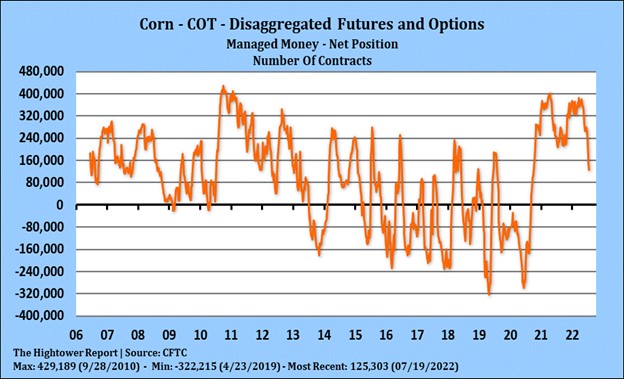

CORN

Corn futures ended higher but off session highs. Fact Russia bombed Ukraine Odessa port raised talk of higher corn futures. Fact the port was not damaged and UN still feels the a Ukraine export deal is still good and Ukraine wants to export grain limited the upside. Some talk that these market are tough to trade given uncertainty of Ukraine war and grain exports or not, US Midwest weather pattern and US Central Bank raising rates to fight inflation. Weekly US corn exports were 28 mil bu. Season to date exports are 2,008 vs 2,426 ly. USDA goal is 2,450 vs 2,753 ly. USDA could drop exports 100 mil bu if export buying is less than hoped. US Midwest could turn warmer and drier next week. 2nd week also looks warm and dry. Some fear this could drop final US corn yield from USDA 177.0. Still, old time crop scout trip from Kansas City toward Ohio then toward Minneapolis found better than expected corn crop with high plant population. Trade expects USDA to rate the US crop 63 pct G/E vs 64 last week.

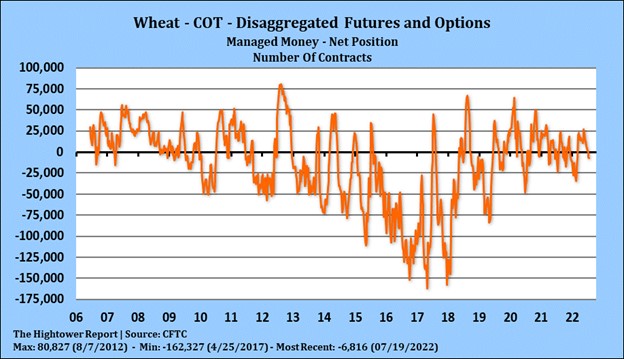

WHEAT

Wheat futures ended higher but off session highs. WU ended near 7.70. Session high was 7.93. KWU ended near 8.38. Session high was 8.53. MWU ended near 8.84. Session high was 8.99. Is a War ever bullish? Weekly US wheat exports were 17 mil bu. Season to date exports are 95 vs 124 ly. USDA goal is 800 vs 804 ly. SRW basis firm on good domestic demand. HRW and HRS looking for demand. Trade expects USDA to rate the US HRS crop 71 pct G/E vs 71 last week. This weeks is annual US HRS crop tour. USDA est ND wheat yield at a record 51 bpa. Last year tour yield was 30 bpa vs final USDA yield of 33.5. US winter wheat harvest is est near 82 pct. Wheat futures still near season low on inflation and recession demand worries vs tightening of World wheat supplies.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.