SOYBEANS

Soybean ended higher. SK ended near 16.64 with a range 16.38-16.83. Volatility continues in the soybean futures market. Word that China Sino Grain may buy 3.5 mmt US soybean to replace sold reserves offered support. SK traded over Tuesdays high. Trade is awaiting USDA estimate of US 2022 soybean acres and March 1 stocks. Trade estimates US March 1 soybean stocks near 1,902 mil bu versus 1,562 ly. Range 1,602-1,965. Trade has been above USDA stocks estimate 9 times in last 17 years and below 8. Trade is also looking for US 2022 soybean acres at 88.7 million vs 87.2 ly. Range 86.0 to 92.2. Trade has been above USDA acreage estimate 12 times in last 17 years and below 5. Weekly US soybean sales are est at 640-1,400 mt vs 412 last week. Trade trying to balance the impact lower China economy and increase Brazil export supplies versus inflation threat and US 2022 weather unknown.

CORN

Volatility continues in the corn futures market. Trade again is worried about Ukraine corn exports and if they can plant intended 2022 acres. CK has had an inside day between 7.26 and 7.48. Trade is awaiting USDA estimate of US 2022 corn acres and March 1 stocks. Trade estimates US March 1 corn stocks near 7,877 mil bu versus 7,696 ly. Range 7,630-8.087. USDA tends to find or lose 300 mil bu of corn on recent stocks report. USDA does not count corn in transit or in barges. Trade has been above USDA stocks estimate 10 times in last 17 years and below 7. Trade is also looking for US 2022 corn acres at 92.0 million vs 93.3 ly. Range 89.7 to 93.5. Trade has been above USDA acreage estimate 9 times in last 17 years and below 8. Weekly US corn sales are est at 600-1,000 mt vs 979 last week. There were rumors last week that EU buyers may have bought 800 mt US corn. Trade still waiting for signs that China will switch Ukraine purchases to US. Trade trying to balance the impact lower China economy, increase Brazil export supplies and Ukraine war versus inflation threat and US 2022 weather unknown.

WHEAT

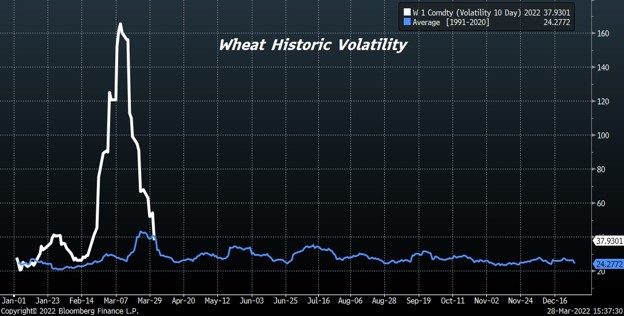

Another wild day in wheat. WK ended near 10.27 with a range of 10.02-10.41.KWK ended near 10.47 with a range of 10.14 to 10.58. MWK ended near 10.58 with a range of 10.5-10.73. Some Wheat is being shipped from Russia. Russia released a document offer humanitarian corridor for Ukraine vessels. Problem in getting vessels on with port mined and loading vessels given damage to port elevators. There was also talk of EU giving subsidies to north Africa wheat buyers to buy wheat. Some said North Africa countries would in turn sell oil to EU. Trade is awaiting USDA estimate of US 2022 wheat acres and March 1 stocks. Trade est March 1 wheat stocks at 1,045 mil bu vs 1.311 ly. Trade has been above USDA 9 times in last 17 years and below 8. Trade est US 2022 wheat acres at 47.8 vs 46.7 ly with range 45.9-48.9.Trade has been above USDA 8 times in last 17 years and below 9.Weekly US old crop wheat sales are est at 50-300 mt vs 155 last week and 150-500 mt new crop vs 367 last week. US south plains 8-14 day weather forecast is warm and dry.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.