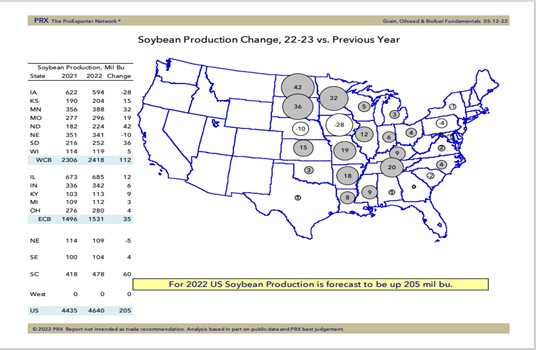

SOYBEANS

Soybeans ended higher. Soymeal gained on soyoil. Talk of higher US crush and export demand offered support. Weekly US soybean exports were near 29 mil bu vs 18 last week and 11 last year. Season to date exports are near 1,782 vs 2,066 last year. April NOPA soybean crush was 169.8 mil bu vs 172.4 expected and 160.3 last year. End of April soyoil stocks were 1,814 mil lbs vs 1,908 in March and 1,702 last year. Range of analyst estimate of US 2021/22 soybean carryout is 175 to 208 vs USDA 235. Trade estimates that 29 pct of US soybean crop is planted vs 12 last week. SN is near the 20 and 50 DMA. Market remains in a 16.00-17.00 range. Will need reports of higher export demand to push above resistance. 12 days of US Midwest rains could slow final plantings and reduce final acres.

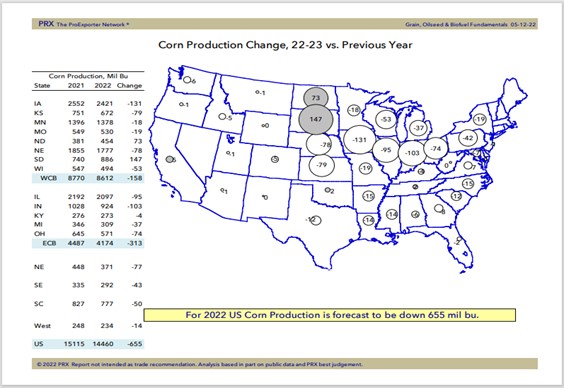

CORN

Corn futures ended sharply higher and following higher wheat prices. Weekly US corn exports were near 41 mil bu vs 58 last week and 78 last year. Season to date exports are near 1,539 vs 1,863 last year. Trade estimates that 49 pct of US corn crop is planted vs 22 last week. Some feel corn planted after May 20 may not yield above trend. USDA corn yield estimate of 177 is equal to last years record but below USDA Outlook yield of 181. Range of private estimates of US 2021/22 corn carryout is 1,195 mil bu to 1,350 vs USDA 1,410. Key is final exports. Range of final exports is 2,575 to 2,700 mil bu vs USDA 2,500. Range of private estimates of US 2022/23 corn carryout is 730 to 1,690. Key is size of US crop and export demand. Private estimates of US 2022 corn crop is 14,430-15,000 mil bu vs USDA 14,460. Trade estimates US 2022/23 feed use near 5,500 vs USDA 5,350, ethanol 5,250 to 5,400 vs USDA 5,375 and exports 2,400 to 2,700 vs USDA 2,400. CN is back over 8.00 with resistance near 8.24. US farmer is not selling this rally. End users are record short 2022 needs.

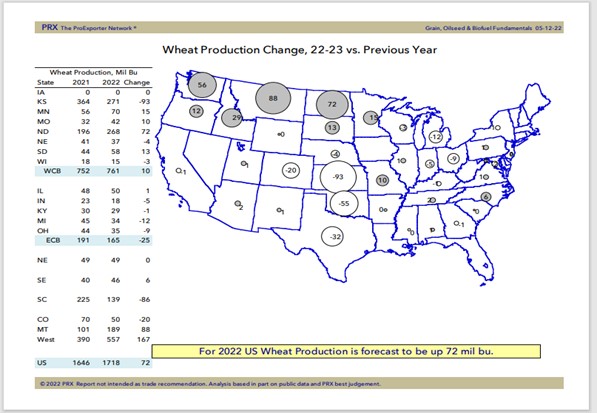

WHEAT

WN and KWN are up the daily 70 cents limit. India banning exports, dry US south plains, EU and wet weather in ND and east Canada weather rallied prices. Limits will be expanded to 105 cents tomorrow. Weekly US wheat exports were near 12 mil bu vs 9 last week and 24 last year. Season to date exports are near 712 vs 897 last year. Trade estimates that 43 pct of US spring wheat crop is planted vs 27 last week. Trade estimates US winter wheat crop will be rated 30 pct G/E vs 29 last week. Matif soared €24 to new all-time highs, matching the 70¢ limit gains at the CBOT and KC and left the USDA with an further 8 Mmt hole in their 22/23 S&D. There is an estimated 1.8 Mmt of wheat currently in Indian ports with no L/C and nowhere to go except back into the interior, and Asian importers were reported to be already desperately trying to find other options. Next week will be the Annual Kansas wheat crop tour.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.