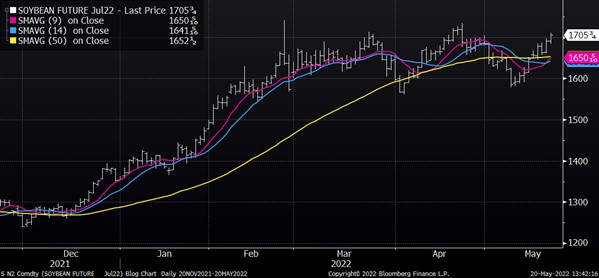

SOYBEANS

July soybeans closed moderately higher on the session today and have now closed higher for 8 of the past 9 trading sessions. Strong demand has helped support the higher market and the buying pushed the market up to the highest level since April 22. Both meal and oil are trading higher on the day. US cash market remains firm as crush margins are strong.

CORN

July corn closed moderately lower on the session but has stayed inside of yesterday’s range. December corn also closed lower on the day as the five day forecast is wide open for the Dakotas, Nebraska, Minnesota and Iowa. The market closed 16 ¾ cents lower for the week. Argentina raised its export quota to 35 million tons from 30 million currently. However, the USDA sees exports at 39 million tons for the 21/22 season. Demand remains firm but traders see the weather as a bearish factor.

WHEAT

July wheat closed sharply lower on the day and closed near the lows of the day. The selling has pushed the market down to the lowest level since May 13. Better rains in the forecast for the next few days has helped to pressure the market, but it appears the weather will turn hot and dry again in the southern plains for the 6–14 day forecast models. In addition, the French wheat crop continues to deteriorate, and temperatures are expected near 95° in many areas this weekend. July KC wheat was also lower on the day and down to the lowest level since May 12. Minneapolis wheat closed down 51 ½ cents for the week and experienced a weekly key reversal from an all-time high. Drier weather in the northern plains should promote increased planting.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.