by Steve Freed, VP of Grain Research

Soybeans, soyoil, soymeal and corn traded higher. Wheat was mixed with KC and Minn higher and Chicago unchanged. US stocks were higher. US Dollar was lower.

SOYBEANS

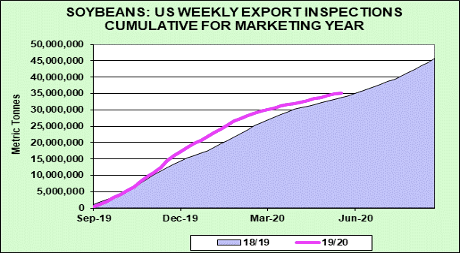

Soybean traded higher. Bulls are looking for China to increase buying of US soybeans. May Brazil soybean exports were a record 12.2 mmt. Some feel their supplies may soon be declining. USDA announced new sales to China today. There are rumors of additional interest by China crushers but no conformation. Bears fear China will not buy large amounts of US soybeans and large US supplies could send prices lower. Bears also suggest US farmers should sell cash above 8.50. Weekly US soybean exports were near 12.2 mil bu versus 19.7 last year. Season to date exports are near 1,289.3 mil bu versus 1,239.1 last year. USDA goal is 1,675 versus 1,748 last year. Concern about lower US China demand could reduce final 2019/20 soybean exports. Most look for US 2020 soybean plantings to be near 70-75 pct. Some have raised their estimate of US 2020 soybean crop due to higher acres. Some are adding to US 2020/21 carryout due to higher supply. July soybean traded back over the 20 day moving average. Next resistance is 8.52.

CORN

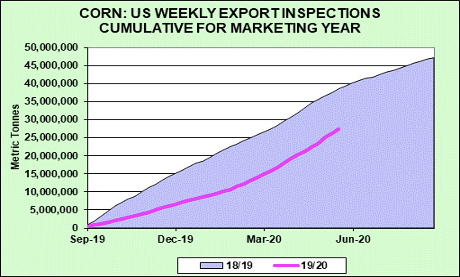

Corn futures traded higher. Higher financial markets and new US soybean sales to China and soymeal sales to the unknown sparked new buying in soybeans. Corn followed. Weekly US corn exports were near 43.0 mil bu versus 43.6 last year. Season to date exports are near 1,076 mil bu versus 1,518 last year. USDA goal is 1,775 versus 2,065 last year. Concern about higher South America supply and lower South America new crop corn prices could reduce final 2019/20 corn exports. Most look for US 2020 corn plantings to be near 90 pct done. US 2 week weather forecast calls for normal temps and normal rains. Tropical storm in US SE could bring rains there. Most doubt it will cause ridge building in US Midwest. First US corn crop rating should be near 72-75 pct good/ex. Some have lowered their estimate of US 2020 corn crop to near 15,400 mil bu due to lower planted acres. Still lower ethanol demand could increase both 2019/20 and 2020/21 corn carryout. This could limit the upside in prices. Bulls feel large speculative short corn futures could get tired and a lack of follow through drop in prices and higher financial markets betting on a slow recovery.

WHEAT

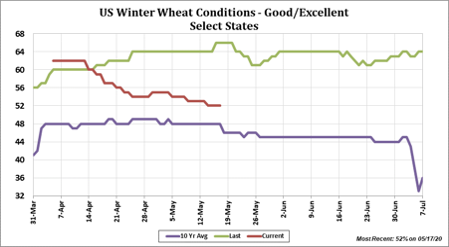

Wheat futures took a back seat to higher US equity and lower US Dollar trade. Higher financial markets and new US soybean sales to China and soymeal sales to the unknown sparked new buying in soybeans. Corn followed. Chicago wheat is still traded lower. KC and Minn managed some gains. Bears still feel that cash sales should be made closer to 5.30 WN. Rains fell across most of US Midwest and east section of south plains. West HRW missed the rains. Some feel final US 2020 wheat crop will be down from USDA May guess but not enough to push prices higher. There were rains in parts of east Europe and west Russia. West and North Europe forecast looks dry. Weekly US wheat exports were near 16.8 mil bu versus 19.5 last year. Season to date exports are near 896.1 mil bu versus 889.2 last year. USDA goal is 970 versus 936 last year. Concern about lower World trade demand and USDA May estimate of record World 2020/21 wheat end stocks continues to offer resistance to prices. Key could be Russia supplies and their exports and export pace.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.