CORN

Prices were $.10-$.12 lower for the day however a couple of cents higher for the week. Spreads were mixed. During the Govt shutdown flash sales amounted to just over 4.9 mil. tons with nearly 3.5 mil. tons going to Mexico. Sales to unknown totaled 976k. US stocks held above 2.1 bil. bu., a 7 year high. While US export demand will likely remain stout, without a weather problem developing in SA look for Dec-25 to pull back to the Oct-25 lows near $4.10.

- US production cut 62 mil. bu. to 16.752 bil., 195 mil. above expectations

- US yield t record 186 bpa, however down from 186.7 bpa in Sept-25

- Old crop 24/25 feed usage cut sharply raising stocks to 1.532 bil. bu. (Sept 30th data)

- New crop 25/26 demand up 100 mil. bu. on higher exports

- US 25/26 ending stocks at 2.154 bil. were up 44 mil., slightly above expectations

- Brazil’s 24/25 production was increased 5 mmt to 136 mmt.

- Global 25/26 stocks little changed at 281 mmt, slightly below expectations

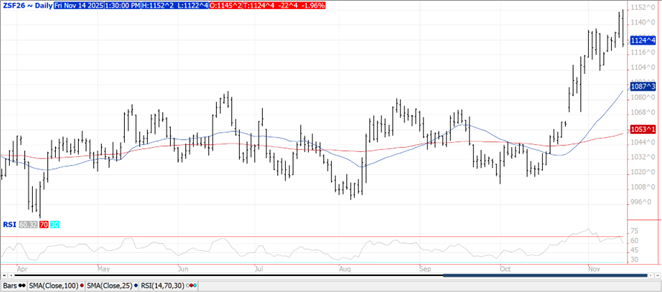

SOYBEANS

Prices were lower across the complex with beans $.20-$.22 lower fearing exports may not live up to USDA projections, meal was off $6 while oil was down 10 points. Outside day lower for Jan-26 beans after stretching out to a 17 month high on early strength. First support is at the November low at $11.03 ½ with gap support between $10.63-$10.70. US prices will need to fall relative to Brazilian FOB offers to better compete in global marketplace, in particular to China were US still has a 10% tariff differential working against the US farmer. Flash sales to China during the Govt. shutdown were only 332k mt, while sales to unknown at 616k combine to be less than 1/12th of the 12 mmt the Trump Admin. claims China will purchase by the end of the year.

- US Production cut 48 mil. bu. to 4.253 bil., 13 mil. below expectations

- US yield at record 53 bpa, however down from 53.5 bpa in Sept-25

- Old crop 24/25 crush raised 15 mil. bu. lowering stocks to 316 mil. bu.

- New crop 25/26 demand lowered 51 mil. on lower exports

- US 25/26 ending stocks at 290 mil. were down 10 mil., slightly below expectations

- Brazil’s 24/25 production up 2.5 mmt to 171.5 mmt. No changes to new crop

- Argentine 25/26 exports increased 2.25 to 8.25 mmt.

- Global 25/26 stocks cut 2 mmt to 122 mmt, below expectations of no change

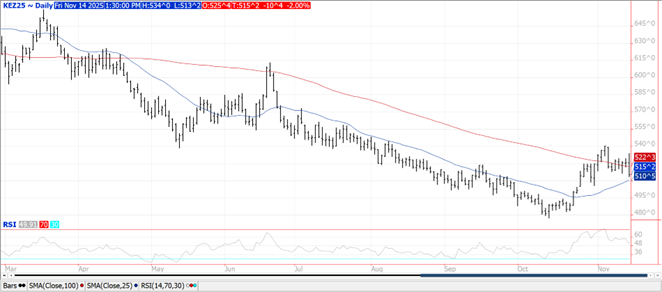

WHEAT

Prices ranged from $.05-$.12 lower with MIAX futures to stronger class. Despite the weakness, spreads firmed across all 3 classes.

- 2025/26 ending stocks increased 57 mil. bu. to 901 mil., 35 mil. above expectations

- Stocks rose across all 3 major classes with HRW up 35 mil., HRS and SRW both up 9 mil. with white up 6 mil.

- Stock increase due to higher production for Sept. 30th, no change in demand

- Global stocks surged 7.3 mmt to 271.4 mmt, well above expectations

- Global production up 12.7 mmt to 829 mmt

- Production increased in Argentina, Australia, Canada, EU, Russia, Kazakhstan and US

Charts provided by QST.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.