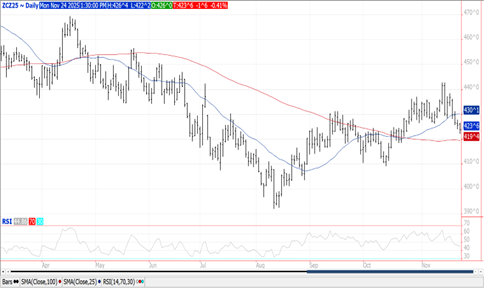

CORN

Prices were steady to $.02 lower in quiet 2 sided trade. Spreads eased ahead of FND on Friday for the Dec-25 contracts. Dec-25 traded to its lowest level in a month however still holding above its 100 day MA at $4.19 ½. Friday’s CFTC data showed MM’s holding a short position of 142k contracts as of Oct. 7th. Export inspections at 64 mil. bu. were in line with expectations and just above the 59 mil. needed per week to reach the USDA forecast. YTD inspections at 688 mil. are up 72% from YA vs. the USDA forecast of up 9%. The only noted buyers were Mexico – 23 mil. and Japan with 11 mil. AgRural estimates Brazil’s 1st crop plantings at 93%, up from 85% LW. Data out after the close on Friday showed corn used for the production of ethanol in Aug-25 at 463 mil. bu., slightly above expectations.

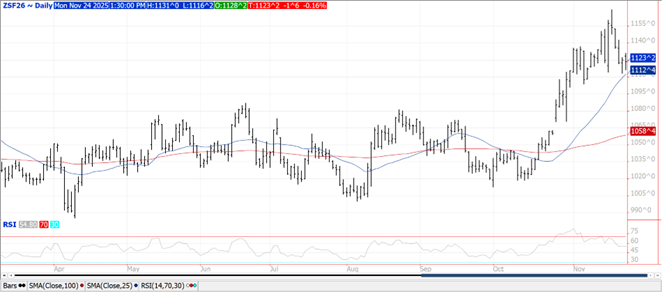

SOYBEANS

Prices were mixed and little changed in 2 sided trade. Beans were mixed and within a couple cents of unchanged, meal was down $1 while oil was slightly lower. Spreads were mixed in beans and oil while slightly lower in meal. Jan-26 beans continue to hold support just above its 50 day MA at $11.12 ½. Dec-25 meal also bounced off its 50 day MA support at $313.50. Dec-25 oil rejected trade below Friday’s low bouncing back to its 50 day MA at 50.31. During the session reports surfaced the Pres. Trump and Xi spoke by phone this AM. Chinese media issued a statement that US/China relations “maintained positive momentum”. Pres. Trump indicates he accepted an offer to visit China in April-26 with Xi visiting the US later in the year. The USDA announced the sale of 123k mt (4.5 mil. bu.) to China. That brings announced sales since late Oct. to just over 1.9 mmt. With spot FOB offers in Brazil slightly below US it’s hard to envision large Chinese purchases in the near term. China was reportedly cancelling bean purchases from Argentina late last week to free up storage for the US shipments. The price difference between the US and Brazil grows out to almost $1 bu. by Feb-26 and that’s before the 10% tariff differential that favors Brazil. AgRural estimates Brazilian plantings have reached 93%. Export inspections at 29 mil. bu. were at the low end of expectations and below the 30 mil. bu. needed per week to reach the USDA forecast. YTD inspections at 402 mil. are down 44.5% from YA vs. the USDA forecast of down 13%. Still no shipments to China. CFTC data as of Oct. 7th showed MM’s were flat in soybeans, short 116k contracts of meal while long nearly 7k contracts of oil. As of Friday’s close we estimate the MM long position at 90k in beans, 14k in oil with the short position if meal down to 77k contracts.

WHEAT

Prices were mixed ranging from up $.03 in spot MIAX futures to $.05 lower in CGO. Spreads finished steady to firmer across the 3 classes. New monthly low for spot CGO. Export inspections at 17 mil. bu. were above expectations and just above the 15 mil. bu. needed per week to reach the USDA forecast. YTD inspections at 472 mil. bu. are up 20% from YA, vs. the USDA at up 9%. Saudi Arabia has reportedly bought 300k mt optional origin wheat for Mch-26 shipment. Cost was $258-$260/mt CF. IKAR reports Russia’s wheat prices at $228/ mt down $1 from the previous week. SovEcon reports prices are a bit higher at around $230. The Trump Admin. suggests big progress was made in peace negotiations in their efforts to end the Ukraine/Russian war.

Charts provided by QST.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.