SOYBEANS

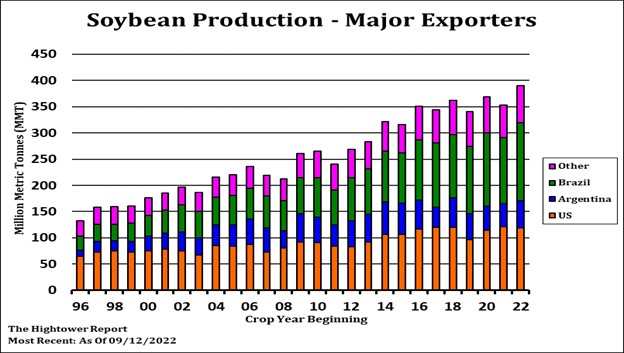

Soybeans ended higher. Talk that China may relax some of its Covid restrictions suggested that China may soon return buying raw materials for import. Commodity prices were pushed and pulled this week on the uncertainty of what Central Banks interest rate policy will be. UN asked Banks to slow increase in rates. IMF suggested a darkening outlook for global economy due to covid impact, Russia invasion of Ukraine and climate extremes. WTO estimated 2023 global trade now up only 1 pct vs 3.4 previous. Trade also is looking for big balance sheet changes on Oct 12 to US and World supply and demand. Some could see US soybean crop increasing and US soybean exports dropping. Trade still looking at a potential SX range from 13.00-14.00. Brazil is looking for a record 2023 soybean crop.

CORN

Corn futures rallied. Higher energy and talk of lower US corn supplies offered support. Dry US summer and now fall weather could drop final US corn yields. Crop is now being harvested quickly. Key will be will there be enough farmer selling to fill demand pipeline. Drop in navigation river water levels could back corn up into the country increase grain piles, slow grain transport and widen futures spreads. Lower basis could force futures to rally to move grain to end users. Trade is looking for big changes to US and World balance sheets for the October 12 supply and demand. Trade is looking for NASS to lower US corn crop. WOB could also lower US corn exports. US corn export commit is down 50 pct from last year. Brazil is looking for record 2023 corn crop. This week there was also talk this week that Russia may extend the Ukraine export corridor deal. There is 64 vessels waiting to load Ukraine grain for export. Mostly corn. This weighed on World corn prices. Ukraine, Brazil and Argentina corn export prices are all below US.

WHEAT

Wheat futures ended higher. USDA report next week suggest lower US wheat supply but could also see lower World demand. Some feel WZ support could be near 8.50 with resistance near 9.50. US CPI could push USD, equities and commodities around. Trade estimates US wheat carryout near 554 mil bu vs USDA 610. WTO revised down 2023 global trade to 1 pct from 3.4 previous. This due to recession threats. IMF also issued a darkening outlook for World economy due to covid, Russia war against Ukraine and extreme climate. Monthly global food prices dropped in September but are still above last year. Drop in US consumer disposable income raises concern about total US food demand.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.