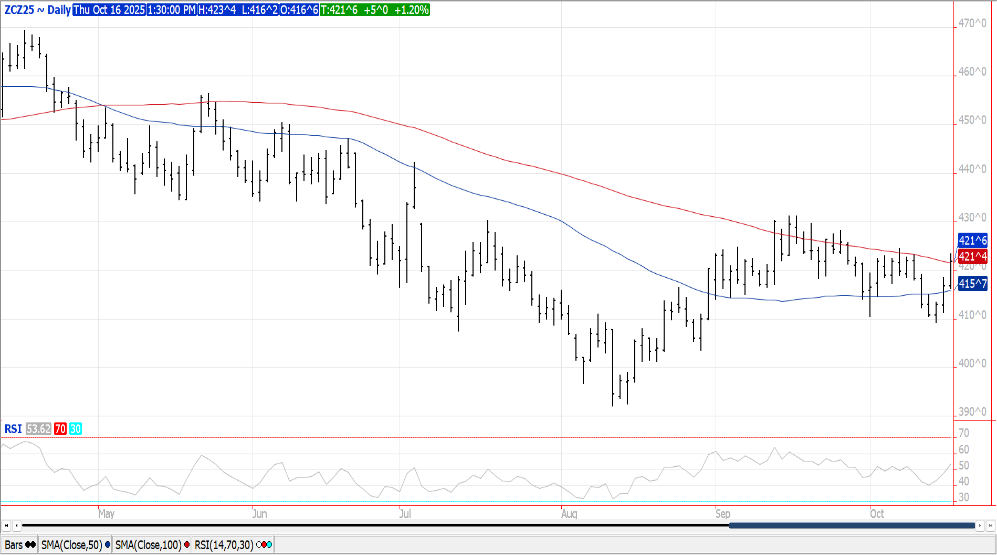

CORN

Prices were $.03-$.05 higher carving out a 3rd consecutive higher close. Spreads also firmed. Dec-25 closed above its 100 day MA resistance however held below the October high at $4.24 ½. Ethanol production ticked up to 316 mil. gallons LW, in line with expectations and up 3% YOY. There was 107 mil. bu. of corn used in the production process, or 15.3 mil. bu. per day, just below the 15.4 mbd needed to reach the USDA corn usage estimate of 5.60 bil. bu. Ethanol stocks slipped to 22.6 mil. barrels, in line with expectations and above YA at 22.3 mb. Implied gasoline usage fell 5.2% to 8.455 tbd and was down 2% YOY. Yields have varied greatly, particularly in areas most impacted by disease. History would suggest the USDA yield est. at 186.7 bpa is too high. Since 1990 the USDA has raised yields in Aug. only to lower them in Sept. (like this year) 8 times. In 5 of those years final yields were below the Sept forecast by an average of 5.3 bpa. The 3 years final yields were higher was by an average of less than 1 bpa.

SOYBEANS

Prices were higher across the complex with bean up $.04 closing well off session highs, meal was up $1 while oil sold off late closing up only 10 points. Bean and meal spreads firmed while oil spreads weakened. Nov-25 beans jumped out to new highs for the week with next resistance resting between $10.26-$10.27 ½. Dec-25 meal recovered late on spreading as oil pulled back. Dec-25 oil rejected trade above its 50 day MA. Spot board crush margins slipped $.01 ½ to $1.58 bu. with bean oil PV holding steady at 47.9%. A slight easing of trade tensions with China enabled agricultural prices to work higher. A spokeswoman from China’s commerce ministry today clarified their recent rare earth restrictions do not amount to an outright ban and that exports will continue “as long as the rare earths are used for civil purposes.” While weekend rains will slow the remaining harvest in the central and ECB, it will help ease drought conditions. Yesterday’s record high NOPA crush for Sept. at 198 mil. bu. provided underlying support. Oil stocks at 1.243 bil. lbs. while slightly above expectations, would imply stronger usage. Also supporting the soy complex was a report from Reuters that suggests China has slowed soybean purchases for Dec/Jan citing higher premiums in Brazil. The report also suggests the Chinese Govt. may use state reserves to supply end users if purchases are delayed further. Their Dec/Jan needs are est. to be roughly 8-9 mmt. Bulls might argue that China may also be waiting to see how talks between Pres. Trump and Xi go if they do meet later this month in S. Korea. After buying around 4k contracts yesterday we have speculative traders pretty much flat in soybeans, essentially a risk off approach building up to the potential Trump/Xi meeting. The EPA reported D4 biodiesel blending credits generated in Sept-25 at 660 mil. were up 21% from the previous month, and the highest since Dec-24.

WHEAT

Prices ranged from down $.02 to up $.04 across the 3 classes at midday. New contract low from MIAX Dec-25 as it finally cracked below $5.50. Both CGO and KC managed to shake off early weakness to close with slight gains. Dec-25 CGO wheat’s premium to Dec-25 corn fell to a new low today, at 1 point trading below $.79 bu. Algeria reportedly bought around 400k mt of durum between 324-334/mt CF depending on vessel size. The wheat is for Nov/Dec shipment. Russia has resumed wheat shipments to Indonesia following a 9 month pause. Egypt has reportedly bought 2 cargoes of French wheat paying $240/mt FOB. Egypt may also be seeking an undisclosed amount of wheat from the Black Sea region as well. Pres. Trump today spoke with Russian leader Putin today describing their talks as “good and productive”. He felt progress was made and will continue to push for peace while adding he felt Putin and Zelenskiy can get together.

Charts provided by QST.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.