CORN

Prices ranged from steady to $.03 higher as spreads also recovered. Dec-25 futures jumped out to a 4 ½ month high while closing a chart gap from July 4th weekend. December also tested resistance at the 50% retracement from the Feb-25 high to the Aug-25 low at $4.35 ¾. A Reuters survey estimates US harvest has reached 73%, below the YA pace of 81%. A S. Korean feed group reportedly bought 204k mt of feed corn from either US, SA or South Africa for Feb-26 shipment. EU 2025/26 corn imports as of Oct. 26th at 5 mmt are down 27% from YA. Tomorrow’s EIA report is expected to show ethanol production range from 320-330 mil. gallons last week, vs. 327 mil. the previous week. While the Nov-25 USDA and WASDE reports look less likely every day.

SOYBEANS

Prices were mostly higher across the complex with beans up $.09-$.11, meal surged another $8 while oil was down 50 points. Spreads across the complex finished mixed. Nov-25 beans have shot up to their highest level in a year while also trading above the 100 week MA on the weekly chart for the first time in over 2 years. Dec-25 meal surged to a 4 ½ month high while closing higher for an 11th consecutive session. Dec-25 oil remains stuck between support at $.50 lbs and its 50 day MA resistance at 51.28. Spot board crush margins rebounded $.02 to $1.49 bu. while bean oil PV slipped to a 5 month low at 45.1%. By mid-session producer selling combined with speculative profit taking drove prices off their highs. So far no details of an expected US/China trade deal have emerged. When Pres. Trump meets with Chinese leader Xi on the sidelines of the APEC Summit in S. Korea on Thursday (Wednesday night local time) it’s expected that any agreement to buy US soybeans would be non-binding and enforced by the threat of US tariffs. US beans to China will still compete with SA offers, while so far no interest from Chinese importers. The Reuters survey estimates US soybean harvest has reached 83%, below last year’s record pace of 88%. Speculative traders yesterday reportedly bought 20k contracts of beans, 5k meal and 3.5k bean oil. Net open interest dropped 17k contracts in beans, however Nov-25 alone fell by nearly 45k contracts ahead of Friday’s FND. US soybean FOB offers at the Gulf have narrowed the gap with SA anticipating a US/China trade deal. A surge in US meal premiums has left the US uncompetitive vs. SA offers. EU soybean imports for the 25/26 MY at 3.62 mmt are down 15% YOY. Soybean meal imports at 5.68 mmt are down 3.6%.

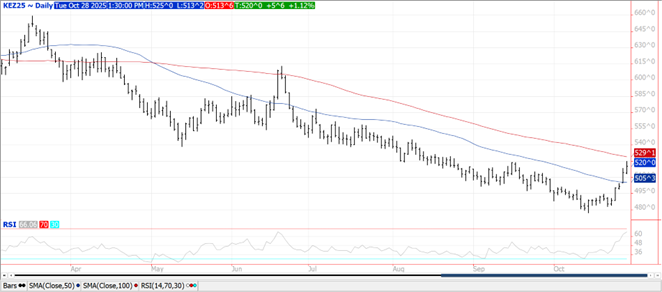

WHEAT

Prices ranged from $.02-$.06 higher across the 3 classes today. Dec-25 CGO stalled just below the September high at $5.35 ¾ with next resistance at the 100 day MA at $5.39. Dec-25 KC did shoot up to a 2 month high with next resistance at the 100 day MA at $5.29. South American forecasts are mostly crop friendly however markets will be on alert for potential damage to Argentina’s developing wheat as AM temperatures fell below freezing in Southern growing regions. The Reuters survey estimates US winter wheat is 85% planted vs. 80% YA. It also estimates 50% of the crop is in G/E condition vs. only 38% YA. Ukraine’s winter wheat plantings at 81% are moving in lockstep with the US. Jordan again passed on purchasing wheat in their recent tender for 120k mt. EU soft wheat exports for the 25/26 MY at 6.25 mmt are down 21% YOY.

Charts provided by QST.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.