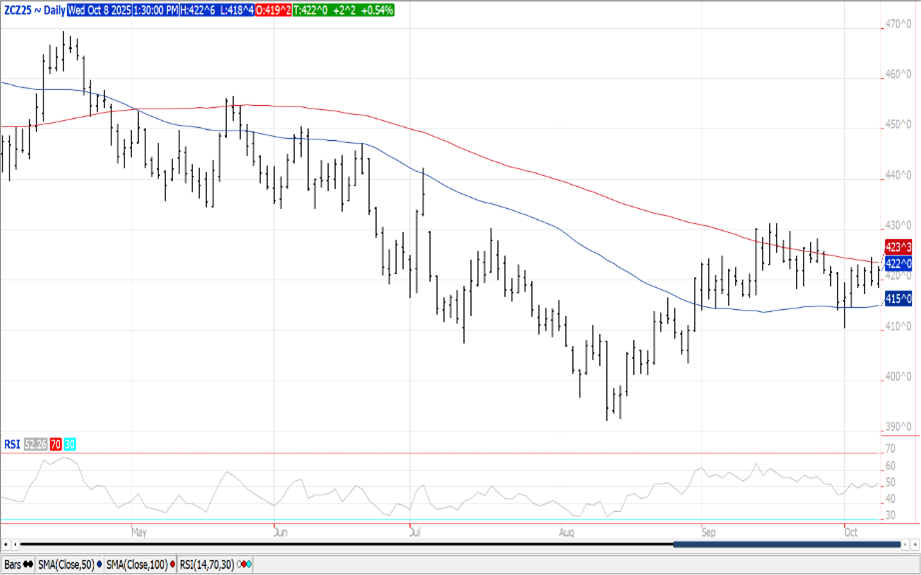

CORN

Prices were $.01-$.02 higher closing near session highs. For now Dec-25 remains stuck between its 50 day MA support at $4.15 and its 100 MA resistance at $4.23 ¼. Tomorrow’s USDA production and WASDE reports have been postponed or cancelled pending Fed. Govt. reopening. Ethanol production snapped back to 1,071 tbd, or 315 mil. gallons in the week ended Fri. Oct. 3rd, up from 293 mil. the previous week and up 3.2% from YA. Production was above expectations. There was 106.7 mil. bu. of corn used in the production process, or 15.25 mil. bu. per day, still below the 15.4 mbd needed to reach the USDA corn usage estimate of 5.60 bil. bu. In the MY to date there has been 492 mil. bu. used, or 14.9 mbd, an annualized pace of 5.439 bil. Ethanol stocks slipped to 22.7 mil. barrels, in line with expectations and above YA at 22.15 mb. Although implied gasoline demand rose 4.7% last week to 8.919 mbd, it was still off 7.6% from same week YA. Although export sales will not be released tomorrow due to Fed. Govt. shutdown, analyst estimates of sales last week range from 48–78 mil. bu.

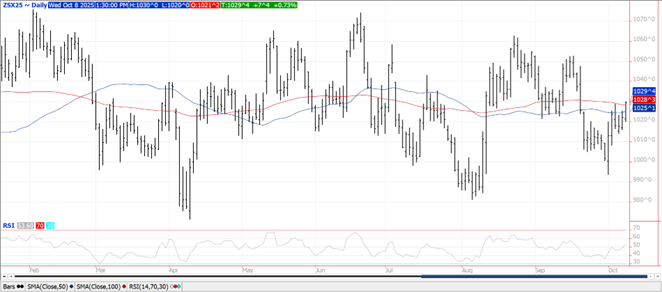

SOYBEANS

Prices were higher across the complex with beans up $.04-$.07 ½ extending session highs near the close, meal was $1-$2 higher while oil was up 45-50 points. Bean and meal spreads firmed while oil spreads were weaker. dm Nov-25 beans closed into new highs for the month while also above its 100 day MA. Dec-25 oil also jumped to a 3 week high closing in on MA resistance just above $.52 lb. Spot board crush margins were little changed at $1.48 ½ bu. however bean oil PV improved to a 2 month high at 48.1%. Argentina’s Labor Ministry ordered the Oilseed Workers Union to suspend plans for a strike over wages and benefits, effectively putting a 15 day pause allowing for negotiations to continue. Union workers had called for a strike starting today. This potential work stoppage may have also contributed to the bull spreading. Malaysia’s Palm Oil Board is set to release its September data this Friday. Analysts expect production to have slipped 3.3% to 1.79 mmt. Exports are expected to have risen 7.7% to 1.43 mmt, resulting in stocks falling to 2.15 mmt, down 2.5% from the end of August. Despite no soybean sales on the books to China, sales to all other countries at only 404 mil. bu. (last available data) is also historically low, however still up 4% from YA and 9.5% above 2019/20, the last trade war with China.

WHEAT

Prices recovered late to scratch out a slightly higher close. None of the 3 classes established new contracts lows for their spot Dec-25 contracts. Dec-25 CGO premium to Dec-25 corn however fell to a new low at $.85 bu. After a slow start Russian exports in Oct-25 are expected to increase to 5.1 mmt, up from 4.6 mmt in Sept. Despite the increase they are still expected to come up shy of the 6.1 mmt shipped in Oct-24. Ukraine’s exports in the July thru Sept period at 4.7 mmt are also down 23% YOY. The slow sales from the Black Sea region have benefited demand for US wheat with YTD commitments (last available data before Fed. Shutdown) up 24% vs. YA vs. USDA forecast of up 5%. Expectations for Black Sea shipments to improved can’t be viewed as bullish for global prices just ahead of S. Hemisphere harvest.

Charts provided by QST.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.