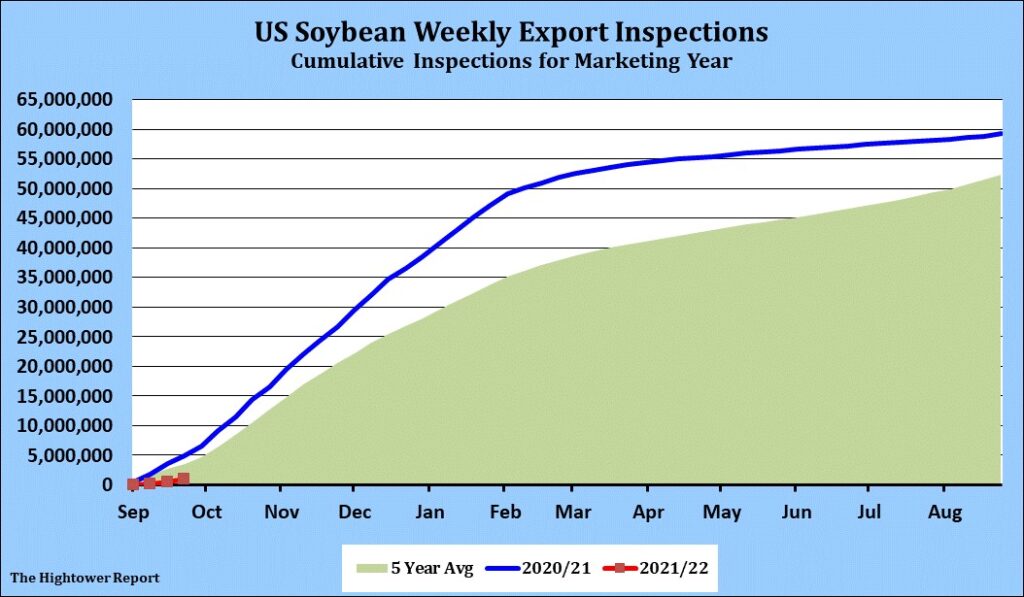

SOYBEANS

Soybeans traded higher following higher commodity prices and talk of increase China buying US and lack of new US farmer selling. Trade will be watching this week US crop ratings and harvest progress. Trade will also be watching if US Congress increases the debt limit, passes new spending bill and NASS est ofUS Sep 1 stocks. Weekly US soybean exports were 16 mil bu vs 47 last year. Season to dale exports are near 34 mil bu vs 184 last year. US has loss 150 mil bu soybean exports due to the gulf being closed. Wil be interesting to see if weekly exports pick up to try to catch up to last years pace. USDA est US soybean exports near 2,090 mil bu vs 2,260 last year. Trade est US soybean harvest near 12 pct. Early yields may be 1-2 bpa below farmers expectations. SX tested near 13.00. SX support 12.74. Resistance 13.20.

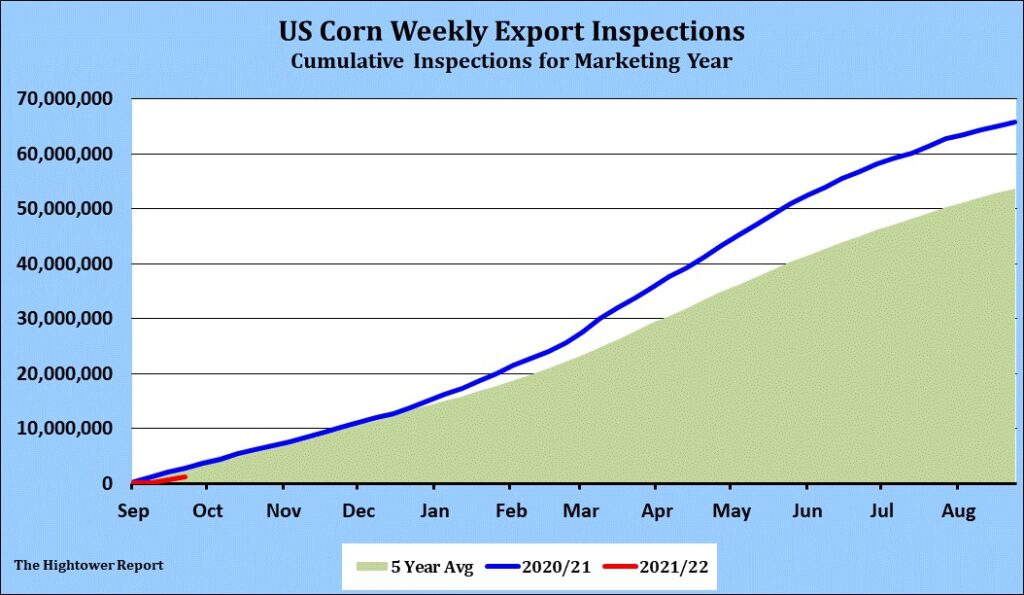

CORN

Corn futures rallied sharply on a lack of overhead selling, higher energy prices and rumors China was asking for US corn prices for imports. Hurricane IDA closed US gulf exports for September. Some had thought China would be aggressive buyers/shippers of US corn in JFM. Some fear though there may not be enough time to ship the 20 mmt of US corn they need before 2022 South America harvest. Weekly US corn exports were near 20 mil bu vs 32 last year. Season to date exports are 45 mil bu vs 111 last year. USDA goal is 2,475 mil bu vs 2,745 ly. Some est exports closer to 2,600. Trade est US corn harvest near 19 pct. Yields are below farmer expectations. Trade is assuming US 2021 corn crop near USDA 14,996 mil bu. Trade also est 21/22 feed/residual near 5,700 mil bu vs 5,725 ly and ethanol 5,300 vs 5,200 ly. Trade est US 2021/22 exports near 2,600 vs 2,745 ly. Earlier some est were as high as 2,800 due to lower Brazil supplies. Corn futures may be undervalued if demand is higher and supply is lower. Trade est US 21/22 corn carryout near 1,235 mil bu vs USDA 1,408 with a 176.3 yield.

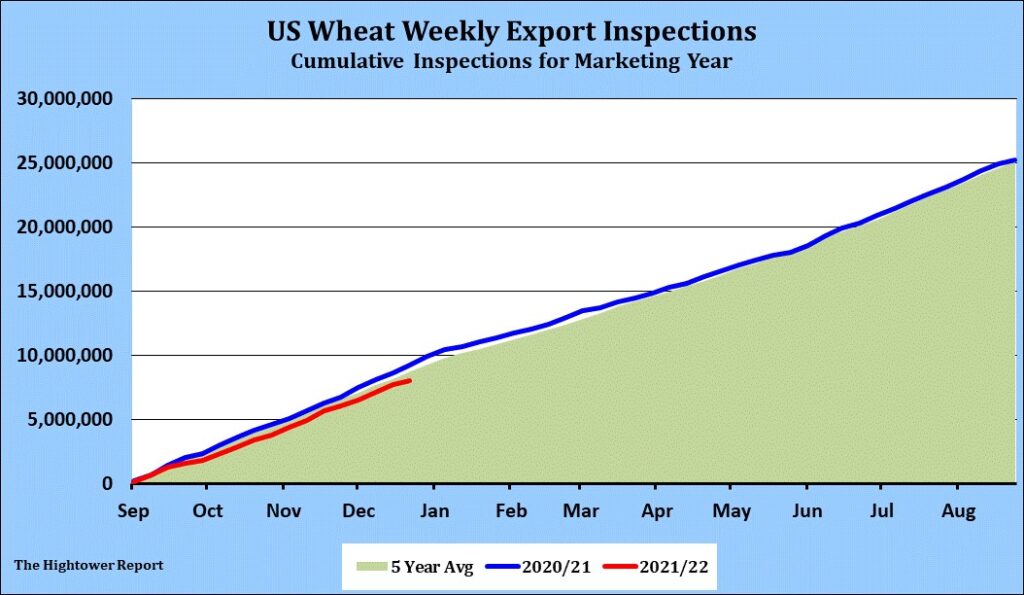

WHEAT

Wheat futures closed mixed. Some feel WZ is in a 7.00-7.40 trading range. WZ ended near 7.22. Managed funds have added to WZ net long on chart buying, post US harvest bounced and fact many World buyers are short wheat needs. High prices and freight cost limits new aggressive buying. Talk of lower Canada export supplies, lower EU milling quality export supplies and talk that after Jan 1, Russia may ration wheat exports offers support. Recent rally in US Dollar and concern about higher global food and fuel prices reducing consumer food demand offers resistance. Weekly US wheat exports were near 10 mil bu vs 21 last year. Season to date exports are near 294 mil bu vs 340 last year. USDA est World 21/22 wheat trade near 199 mt vs `99 ly. US 24 vs 27, Canada 17 vs 26, EU 35 vs 29 and Russia 35 vs 38 US.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.