Soybeans, soymeal, soyoil, corn and wheat traded higher. US stocks were lower. US Dollar was lower. Crude was higher. Gold was higher.

SOYBEANS

Soybean traded higher after USDA dropped their weekly crop ratings and announced new US soybean sales to China. SX traded back above 10.50 and increased its inverse over 2021 contracts. Managed funds are net buyers of 8,000 soybeans, 2,000 soymeal and 3,000 soyoil. We estimate Managed funds are net long 244,000 soybeans, 80,000 soymeal and 87,000 soyoil. USDA announced 264 mt US soybean sold to China. There is talk of improved chances for rain in parts of Brazil and Argentina. Still old crop Brazil soybean supplies are tight and there is talk they may have to import soybean to crush before their 2021 harvest. Argentina farmer continues to be a slow seller of soybean which could reduce their crush. This is helping soymeal futures. USDA estimated that 61 pct of the US soybean crop is harvested. Most feel US farmers will complete soybean harvest by this weekend. Then the question is how will the pipeline be filled for record exports after harvest. USDA rated the crop 61 pct good/ex versus 62 last week. Best crops are in KY, MN, MO, TN and WI. Lowest rated crops are in IA, LA, ND. and OH. One group could see higher futures into Q1 2021 then gradual drop in prices into fall of 2021 assuming normal US 2021 crop

CORN

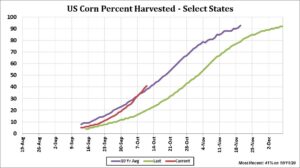

Corn futures traded higher after USDA lowered slightly their estimate of the US 2020 corn Crop and announced new US corn sales to China. Managed funds are net buyers of 7,000 corn. We estimate Managed funds are net long 171,000 corn contracts. China corn futures continues to trade higher. Prices are near $9.71 and could soon test $10.00. Some feel higher prices could be due to part of the crop dropped due to flooding. Others feel stocks could be down due to aggressive selling of reserves. Higher margins could increase their demand for imported corn. USDA did announce 420 mt US corn to China. Some feel they may have bought a total of 1.0 mmt recently. Some feel China may take 20-25 mmt of imported corn, 3-4 from Ukraine, 1-2 from Brazil and 18-19 from US. USDA still estimates China corn imports at only 7 mmt. USDA estimated US corn harvest near 41 pct done and rated the crop 61 pct good/ex versus 62 last week. Best crops are in KY, MN, MO, SD and lowest rated crops are in IA, MI. and OH. One group could see higher futures into Q1 2021 then gradual drop in prices into fall of 2021 assuming normal US 2021 crop.

WHEAT

Wheat futures started lower on talk of potential rains across portions of US south plains and SW Russia. Rally in soybean and corn futures and late drop in US Dollar may have helped rally wheat futures into the close. Managed funds were late buyers 2,000 wheat. We estimate Managed funds are net long 31,000 wheat. Wheat futures continue to chop around. One weather map is dry across US south plains. The other has rains in east half of the HRW growing area. USDA estimated that 68 pct of the US winter wheat crop is planted with 41 pct emerged. USDA will start reporting crop conditions on Oct 26. Russia farmers continue to be slow sellers of wheat. Russia fob export prices is up to near $249 or $6.33 per bushel. One group could see slow trend higher in wheat futures into Q2 2021. This due to talk of lower Russia and Argentina 2021 crops. There could also be ongoing dry conditions across US south plains HRW growing area.

Click here for full report

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.