AG FUNDAMENTALS:

Last week’s ethanol production numbers will come out later today, and export sales will be reported tomorrow. The corn market would like to see a continued high corn demand narrative with expectations of ethanol production to be above 1.05 million barrels per day and meeting on exports. Hoping someone puts a cap on the cases of bird flu in Georgia. President Trump did sign an executive order that froze any new rules that have been published in the Federal Register which included the 45Z Clean Fuels Production credit from the Inflation Reduction act. A group of senators reacted to this by reintroducing the “Farm to Fly Act”. This bill would accelerate the production of SAF (sustainable aviation fuel). Soybeans are also on edge waiting for what happens in 8 days regarding tariffs. Trump has mentioned 10% tariffs on China, 25% tariffs on Canada and Mexico, sanctions and tariffs on Russia and possible levies on trade with the EU. Additionally the result of the Ukraine and Russia conflict as those sanctions take effect will effect wheat and oil prices. Trump is expected to speak live today at 10:00am CST.

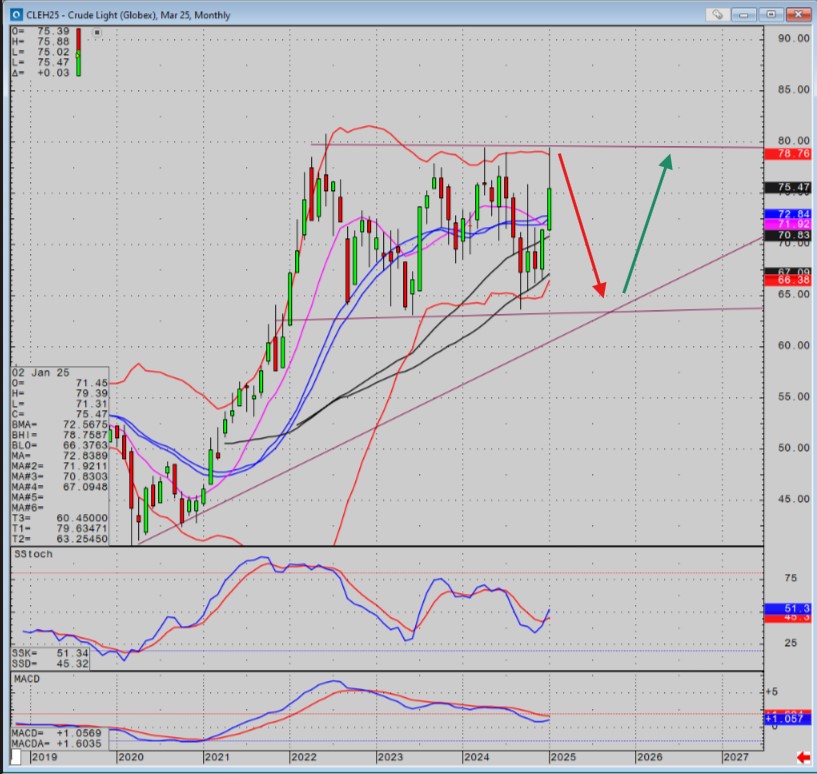

Crude Oil has been trading in a range between $63 and $80 per barrel for the last 3 years. Expectations of drill baby drill should increase supply and drop prices lower. Lower energy prices should help boost economy. Flourishing economies then tend to drive oil higher.

Export & World News

South Korea purchased 136K MT of animal feed corn and 65K MT of animal feed wheat. Japan bout 126K MT of food quality wheat from the US, Canada and Australia. Jordan issued an international tender to buy up to 120K MT of milling wheat.

Malaysian palm oil futures were down 18 ringgit overnight, at 4190.

Daily Trading Limits: Corn $0.30 (expanded $0.45); Soybeans $0.85 (expanded $1.30); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

>>Interested in more commentary by Joe Mauck? Go HERE

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.