MORNING LIVESTOCK FUTURES OUTLOOK

LIVE CATTLE

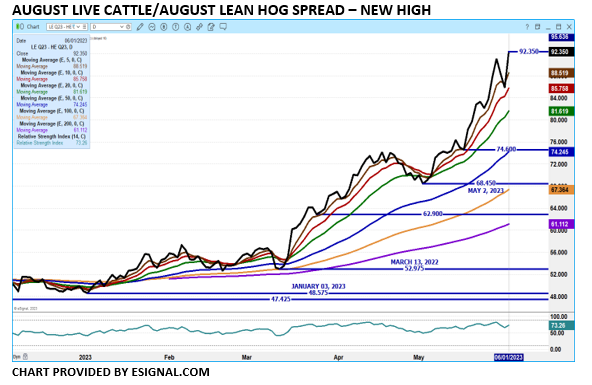

Trade volume was very active with volume on August 55,862 contracts. With the strength in the cash cattle market in May, the gain in Choice boxed beef over the past week and having Live Cattle futures discount to cash cattle, the ballistic trading Thursday going from a non-spot month moving into a spot month Monday afternoon was bound to happen. On top of it, cattle weights are down, fewer cattle are grading Choice, slaughter for the year is down and most importantly packers must buy cattle to fulfill the largest percentage of beef moved, previously contracted beef.

LEAN HOGS

Hogs were lower Thursday except for June with June, up likely on shorts getting out. The CME Lean Hog Index is at $79.53 and June Lean Hogs are at $83.55. Of course there are close to 2 weeks before June Lean Hogs expire and spread could remain $4.05 or wider or less. Traders are bull spreading summer hogs but are bear spreading July/August and buying fall and winter hogs.

Learn more about Chris Lehner here

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.