MONTHLY COMMODITIES MARKET OVERVIEW

>>Read the complete September 2025 Edition HERE

KEY HIGHLIGHTS

GRAINS

Despite a bearish USDA report, corn prices have held in sideways trading pattern for much of September. The USDA raised their US corn production forecast another 72 million bushels to 16.814 billion, roughly 300 million above expectations. This while US yields fell 2.1 bushels per acre to 186.7, still a record high. Harvested acres rose another 1.356 million from August to 90.047 million. Planted acres rose across several key states, including Nebraska at +250,000, Minnesota and Illinois at +200,000, South Dakota at +150,000, and Indiana, Kansas, Missouri, and North Dakota +100,000 each.

Until recently, soybean prices held a tight range in the wake of a neutral to slightly bearish USDA report. The recent setback was a result of the lack of a trade deal with China following a recent conversation between President Trump and Chinese leader Xi and from a surprise decision in Argentina to temporarily suspend their agricultural commodity export taxes.

Wheat prices have continued to grind sideways to lower across the three classes despite tightening supplies in the US. In their September update, USDA lowered the 2025/26 US ending stocks forecast by 25 million bushels to 844 million, 20 million below expectations. Exports were raised 25 million to 900 million, the highest in five years. The revision higher consisted entirely for HRW wheat (KC futures).

COCOA

Rainfall has finally begun to arrive in West Africa after a seasonal late-summer dry spell overstayed its welcome. The rains shifted north in the second half of July out of the main growing areas, which is a seasonal pattern. They would normally return in late August/early September but were a week or two late. Now that the rains have returned, the market is back approaching its low from mid-July, which came on disappointing second-quarter grind data. Third-quarter grind number for Asia, Europe, and North America are due to be released on October 16. The trade will be watching the weekly cocoa arrivals in the upcoming weeks to gauge the progress of the 2025/26 main crop, which officially begins October 1.

COFFEE

December Coffee made a new contract high on September 16 and proceeded to fall off sharply from that level. The market had been supported by a sharp decline in exchange stocks, as US buyers looked to procure coffee in the wake of the 50% tariff placed on Brazilian imports. Traditionally, about one-third of the coffee that the US consumes comes from Brazil. As of this writing there were a couple of events that offered hope of a solution to this dilemma. The tariffs have been challenged in the courts, and the case appeared to be headed to the US Supreme Court in November but may not be decided until next year.

COTTON

December Cotton has been in a choppy, sideways pattern since putting in a low in April in the wake of the “Liberation Day” tariff announcements. At the time, the tariff news represented the worst case scenario, as the market still had to face the growing season and lower planted area. Now that the end of the growing season is approaching, most of the crop uncertainty is gone, leaving the market to focus on export demand. The September 21 Crop Progress report showed 47% of the US crop was rated good/excellent as of September 21, down from 52% the previous week but up from 37% a year ago and above the five-year average for that date at 42%. Texas was 41% G/E, down from 47% the previous week but up from 23% a year ago and above the five-year average at 27%. Texas was the only state in the top five producers that were above average, but in a good year it can represent 40% of US production.

SUGAR

Ample supply is the order of the day in the sugar market. Above average monsoon rains have helped cane crops in Thailand in India get off to a strong start, and Brazil’s 2025/26 crop has recovered after a slow start this season. The UNICA report for the second half of August showed that cumulative Brazilian Center South sugar production for the marketing year that began in April was running 1.9% below year ago levels as of September 1 after being 7.7% behind on August 1 and 14.3% behind on July 1. Indian sugar producers are hoping the government expands the export quota to 2 million tons in 2025/26 from 1 million in 2024/25.

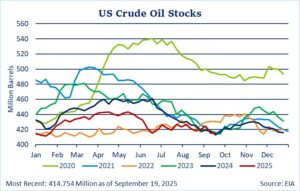

CRUDE OIL

The crude oil market has been in a choppy, sideways pattern since late July, supported by the prospect of new sanctions against Russian oil, a series of Ukrainian drone attacks on Russian oil facilities, and tight US crude oil stocks, but gains have limited by the prospect of a wave of Mideast Crude Oil that is expected to hit the global market this fall. Between April and September, OPEC+ members agreed to a series of output increases of roughly 2.2 million barrels per day. The agreed to another increase in October, though at a much smaller rate of 137,000 barrels per day after increases of 555,000 bpd for September and August, and 411,000 bpd in July and June. The increases in production were attributed to the desire to regain market share from the US and/or the desire on Saudi Arabia’s part to discipline other OPEC+ member that have been overproducing, particularly Kazakhstan and Iraq.

NATURAL GAS

US Natural Gas production has been at or near record highs this summer, and that and a lack of any widespread heat wave across the US has allowed domestic supply to increase at a faster than normal rate. This has helped send nearby prices to their lowest levels since last November. In the 29 weeks since the “build season” began on March 1, weekly increases in US supply have been above the five-year average 22 times and below the average seven times. As of September 19, US storage was 0.4% above a year ago after being 27% below in early March. This was the first week it was above year ago levels since January. Supply was 5.7% above the five-year average after being 12% below in early March.

LIVE CATTLE

Cattle and beef markets before and after Labor Day 2025 traded much as expected. The summer holidays, Memorial Day, July 4th, and Labor Day all had similar patterns. The holidays are when families and groups of friends gather, grills and barbeques across the US are fired up, and steaks and ground beef are in high demand. The extremely light cattle slaughter this year has exacerbated the normal moves. Once Labor Day ends, beef demand slows. For example, on August 1 the cumulative choice beef price was $364.15/cwt, and the 5-day average steer price was $239.69/cwt. By August 29 (Labor Day weekend), choice beef was priced at $415.41, and the 5-day average steer price was $243.37. Beef prices had gained $51.26 during the month. Prices dropped after the Labor Day surge, and by Friday September 15, choice beef was down to $400.04, and the 5-day average steer price was down to $240.19.

LEAN HOGS

US pork exports are declining, and the US is losing market share. The US Meat Export Federation reported on September 5 that total pork exports from January through July were down 4% from last year, with pork cuts down 2% and variety meats down 10%. Exports to China are down 16%, with exports to Japan down 10%, South Korea down 16%, and Canada down 17%. Mexico was the largest buyer during the period, and it was up 2% from last year. Australia, New Zealand, and the Philippines have seen reductions. In September there was a report that for the first time in more than 40 years Canada was the largest pork exporter to Japan.

STOCK INDEX FUTURES

Stock index futures have posted strong gains over the past month, with all the major indices hitting record highs, buoyed by the AI-driven rally and expectations of further interest rate cuts from the US Federal Reserve. The Nasdaq led the charge, climbing more than 5.8% as it benefited from solid third-quarter earnings and AI optimism. The S&P grew nearly 3.5%, and the Dow gained 1.7%. While macroeconomic uncertainty persists, investor sentiment has improved on the back of stable consumer spending and a softening in the labor market on ideas this may prompt the Federal Reserve to continue to cut interest rates through the end of the year. Retail sales grew 0.6% in August, beating out expectations of +0.2%, and July’s figures were revised higher to +0.6%. The August nonfarm payrolls report was dim, with the economy adding a mere 22,000 jobs, well below forecasts. The markets took the payroll numbers in stride, as this added to expectations that the Fed would cut rates at its meeting in September, which it eventually did

US DOLLAR INDEX

The US Dollar Index declined 0.4% over the past month, led by expectations that the Fed would cut interest rate cuts in its September meeting and would make further rate cuts into the end of the year. Weak labor figures for August, with job gains of only 22,000 versus expectations of +75,000, contributed to this sentiment.

EURO CURRENCY

The euro has had an impressive performance against the dollar this past month, advancing more than 1.6% on expectations that the European Central Bank would hold its policy rate steady for the remainder of the year while the US Fed lowers rates. CPI inflation in the Eurozone has held at an annualized 2.0% in August, unchanged from July and June and in line with the ECB’s target. Core CPI inflation remained steady at 2.3%. The ECB now projects Eurozone GDP to expand by 1.2% in 2025, up from its forecast of 0.9% in June. Growth for 2026 was revised down to 1.0%, and the 2027 outlook was left unchanged at 1.3%.

BRITISH POUND

The British pound has advanced 0.75% against the dollar in the past month against a backdrop of worries over tax hikes and the Bank of England leaning into an inflation fight. The BoE lefts its key interest rate unchanged at 4% and scaled back a program designed to shrink its holding of government bonds. Seven members of the Monetary Policy Committee voted to leave borrowing costs as they were, with only two members supporting another rate cut. BoE policymakers are growing concerned about a pickup in inflation, which has been driven by increases in food prices and a series of prices which are guided by government policy, including a 26% increase in water charges. Inflation numbers for August stood at 3.8% year on year, unchanged from July after starting 2025 at 3.0%.

INTEREST RATES

The Treasury markets has seen moderate volatility over the past month, with yields seesawing in the wake of the FOMC’s 25 basis-point rate cut in September. Fed Chair Powell said they are in a “meeting-by-meeting situation” regarding the outlook for interest rates, and he characterized the easing as a “risk management cut.” Powell added that the Fed ready to move on any economic developments and that the committee felt cutting rates was appropriate given the downside risks to the labor market. He also noted that no “risk-free” path is available.

GOLD

Gold prices have soared over the past month, with December COMEX contracts up more than $400 (12%) since late August. The rally in gold has been due to expectations of interest rate cuts from the Federal Reserve, which weaken the dollar and increase gold’s attraction as a store of value. Weak labor data and tame CPI and PPI inflation numbers for August has investors betting that the Fed would lower rates at its September meeting and continue to do so through the end of the year.

COPPER

US copper futures have recorded strong gains over the past month, climbing more than 4% on support from interest rate cuts in the US and supply disruptions around the world. Chile’s state copper miner, Codelco, said its biggest mine will take longer to return to full production than originally forecast in the wake of a deadly tunnel collapse in July, which would make the decline in production more the initial estimate of 33,000 metric tons. The mine is expected to produce slightly more than 300,000 tons this year, down from 356,000 in 2024. Production also remains suspended at Freeport Indonesia’s Grasberg mine, one of the world’s biggest, following an incident in early September.

Interested in more futures market commentary? Explore our Market Dashboards here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.