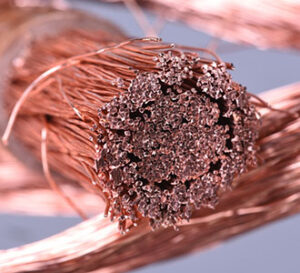

COPPER

While the copper market is obviously undermined by the negative macroeconomic shift following hot US inflation readings yesterday, the bull camp is fortunate beleaguered Chinese equity markets are closed for holiday leaving room in the headlines for slightly improved sentiment from the Lunar New Year holiday. The bull camp hopes the Chinese holiday will temporarily lift Chinese animal spirits and that in turn should help March copper respect $3.70. Unfortunately for the bull camp, China also showed “combat readiness air patrols” off Taiwan with Chinese naval vessels coordinating the exercises and that could cloud the Chinese economic outlook. However, an Australian forecast predicting a strong start to 2024 Chinese commodity imports should cushion copper against bearish outside market forces of a strengthening dollar and rising interest rates. However, LME copper stocks fell again overnight and are at their lowest levels since September, which could reflect improved global demand. While China remains on holiday, reports that their Lunar New Year travel will reach a record high this year should provide support to the copper market as that could be a sign of stronger Chinese demand during the rest of the first quarter.

GOLD / SILVER

While the magnitude of yesterday’s US CPI upside surprise was not significant, the markets were clearly undermined by another US data point which appears to push back US rate cut timing. Today the markets will have a pause from US inflation news with several Fed speeches potentially providing some fireworks. However, the US dollar is sitting right on the spike up highs from yesterday early today leaving the currency influence on gold and silver bearish. The CME’s Fed Watch tool saw the probability of a March rate cut fall from 15.5% before the CPI results to only 8.5% afterward, while the chances of a May rate cut fell from 58.1% before the CPI results to 37.6% afterward, this morning the CME Fed watch tool gives the probability of a June rate cut at 50.3%. Fortunately for the bull camp today’s US scheduled data will offer little information except for the weekly mortgage approvals report for the week ending February 9th and with mortgage rates approaching the highest levels in nearly 2 months last week, that report could be soft and minimally supportive of the bull camp.

Interested in more futures markets? Explore our Market Dashboards here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.