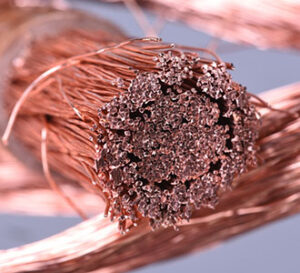

COPPER

Despite declines in Chinese equity markets overnight, ongoing strength in the dollar and a very minimal increase in Chinese imports of copper ore and copper concentrate in the first two months of the year, copper prices have forged a higher high and a seven-day high. In fact, the Chinese import volumes combined for a 0.6% gain from the first two months of last year. However, Chinese copper plate and copper strip imports jumped sharply perhaps because of the efforts to reduce domestic smelting capacity. Furthermore, the copper trade is emboldened by a slightly favorable Chinese Caixin manufacturing PMI readings yesterday which some economists saw as a possible turning point for China after months of contraction in that report. However, recent strength in the dollar, soft US equities, and surging US interest rates are likely to provide outside market headwinds for the copper trade. News from China regarding treatment charges took a fresh turn yesterday as the Chinese copper smelters purchase team has yet to set buying guidance for copper concentrates for the second quarter. The Chinese smelter team also failed to provide guidance in the second quarter of 2021 and with the copper market already in a fully involved bull move, it appears the lack of guidance resulted in a top early in the second quarter.

GOLD & SILVER

The record run in gold prices continues and has pulled silver prices up seemingly against headwinds. Utilizing typical market interactions, the gold run seems to be unfolding in a virtual vacuum. In fact, the gains in gold and silver prices yesterday took place in the face of heavy headwinds from a strong dollar and rising US interest rates. While it is possible the reduced probability of three rate cuts creates economic uncertainty and a measure of anxiety, thereby providing flight to quality interest in gold, that theory is squashed by the lack of anxiety in equities and the lack of upside action in Bitcoin. Certainly, the rally above $85.00 in crude oil provides lift today and perhaps the gold rally is based on speculation that global inflation will not be snuffed out. Obviously, a fresh offensive by Israel is fueling energy prices higher and might be partially responsible for today’s new all-time gold high. However, there are views surfacing in the gold market that many global central banks are liquidating US treasuries and increasing their gold holdings as a percentage of total holdings. While some are suggesting something nefarious is afoot, de-dollarization is something that foes of the US are very interested in. However, if a de-dollarization effort were underway, we doubt the dollar would be hovering near five-month highs. According to the World Gold Council for January, they data showed 1 central bank (Russia) sold gold, while seven central banks bought gold. The bias is up, but volatility should continue to expand especially with the net spec and fund long in gold likely results in the largest net spec and fund long since April 2022. It should be noted that gold ETF holdings have not registered inflows and expectations are that record high gold prices are set to drop Indian gold imports by 90% to the lowest levels since the pandemic.

Interested in more futures markets? Explore our Market Dashboards here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.