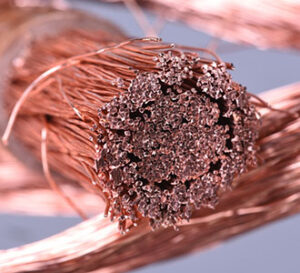

COPPER

Last week, the copper market was presented with several instances of lower South American copper production and prices were unresponsive. Furthermore, LME copper warehouse stocks continue to decline notably and consistently but that potential support was offset by last week’s 6,325-tonne increase in weekly Shanghai copper warehouse stocks. While not as likely or as significant as in the platinum market, traders should monitor the situation in Russia as that could present a significant change in copper supply. However, the copper market is mostly sold-out with the most recent positioning report showing a net spec and fund short position.

GOLD / SILVER

While overnight outside market action is not definitively bearish for gold and silver, the bear camp has help from a stronger dollar, an uptick in US interest rates and signs of deflation in China with their CPI declining 0.2%. Given the pulse up in US interest rate expectations last week and the slide in gold and silver prices, the presence of positive US data and/or a return to risk on in equities will likely pressure both markets back toward recent consolidation low support levels. However, given the tighter relationship between the dollar and precious metal prices (relative to interest rate influences), the action in the dollar is likely to control over the interest rate influences. Therefore, establishing the direction of gold and silver daily will require determining which force is more predominant in the marketplace. We suspect the focus from the markets will be primarily associated with critical US scheduled data which is only 2nd tier data until Wednesday’s US CPI readings. Investment and physical demand signals are mixed for gold with China recently increasing its gold reserves in June from 67.27 million ounces to 67.95 million ounces. On the other hand, investors continue to exit gold ETF holdings at a brisk pace with a consecutive daily out flow pattern of 15 days. Last week gold ETF holdings declined by 326,933 ounces while silver holdings declined by 1.65 million ounces.

PLATINUM / PALLADIUM

While we think October platinum has found value at $900, the market was not bullishly inclined to embrace somewhat positive US vehicle sales last week and as indicated in gold and silver, it is difficult to determine the market’s reaction to today’s Chinese CPI readings. There is the potential for platinum to exhibit weakness if Chinese CPI is soft. Platinum traders should monitor the headlines for the status of the Russian leader’s control and/or any sign of negotiations for peace. On the other hand, if Putin decides to fight on thereby pushing the war well into the future, that could be supportive from the ongoing threat against supply. On the other hand, if there are signs of a peace deal or a regime change in Russia, the platinum market could fall through consolidation low support with a failure of $894.20. As we have been indicating for weeks, the palladium market seems to be on a different fundamental focus than platinum and appears to have “washed out” its technical condition with the net spec and fund long registering a record net short of 8,448 contracts in a market with only 14,889 contracts of open interest.

Interested in more futures markets? Explore our Market Dashboards here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.