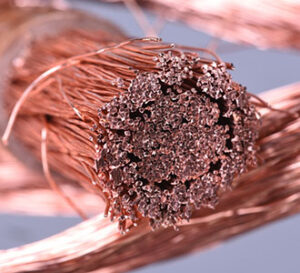

COPPER

While December copper failed to show significant gains on significant broad-based risk on sentiment earlier in the week, the market has pushed higher with 3 consecutive higher highs and has likely secured fundamental support from overnight developments from the LME in London. Apparently, the exchange is tightening delivery rules which will restrict the flow of Russian copper and aluminum with some indications the exchange is also “consulting” on a complete ban of aluminum and copper. Unfortunately for the bull camp, LME copper warehouse stocks have continued a moderate pattern of daily inflows which in turn tamps down supply concerns. In today’s action copper will likely react to US scheduled data particularly data related to jobs. From a longer-term perspective, copper should derive support from predictions from the Antofagasta CEO that current copper prices are nearing cycle lows but could fall further in the short-term due to excessive volatility.

GOLD / SILVER

Fortunately for the bull camp the gold market has managed to stand up to the bounce in the dollar, with the market possibly drafting a minimal amount of fresh flight to quality buying interest from the aggressive military developments involving North Korea, Japan, and the U.S. Navy. Another fresh supportive development this morning came from London where the LME has tightened delivery rules on a major Russian mining entity. It is possible that the LME could ban Russian metals and that would primarily impact industrial metals but could impact precious metals. In another bearish influence gold ETF holdings yesterday declined by 56,117 ounces while silver holdings declined by a significant 2.9 million ounces indicating that recent dollar action has not altered bearish investor sentiment toward gold and silver. While we expect the action in the dollar to remain the primary catalyst for gold and silver prices, the presence of multiple US job data points today could result in significant volatility in treasury yields which in turn could impact gold and silver.

PALLADIUM / PLATINUM

News that the LME was implementing fresh delivery rules against a key Russian mining company could be the beginning of origin stamping of PGM’s, gold, and silver. However, restricting platinum supply flow would have a major negative repercussion for a long list of global users. With significant two-sided volatility this week, pushing palladium prices outside of a 5-month range to the upside, it is clear PGM prices are sensitive to improved economic sentiment. However, to extend bullish control through the end of this week will require “Goldilocks” (not too hot and not too cold) jobs data and ongoing hope of less aggressive US rate hikes. Similarly, the platinum market has also factored in improving demand with the rally off last week’s low reaching $114 and a continuation of risk on, signs of more restrictive LME rules on Russian mining companies, and moderating Fed fear is needed to avoid a poor finish to the trading week in platinum.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.