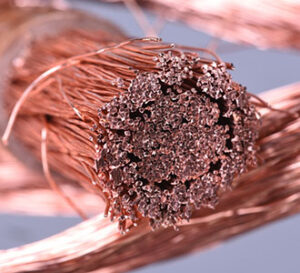

COPPER

At least into the start of the US Thursday trade, the copper charts have forged a noted break down and do not appear to be benefiting from talk of China building up strategic commodity reserves in their latest five-year plan. Perhaps the market is undermined as-a-result of a pattern breaking, noted daily increase in LME copper warehouse stocks of 2,250 tons. However, LME copper warehouse stocks are fresh off a 20-day decline and remain near the lowest level since December 2005.

GOLD / SILVER

Technically the December gold contract forged a 4-day upside breakout yesterday, but the breakout was not a definitive move and so-far has lacked sustained momentum. Unfortunately, for the bull camp the gold market has not benefited from news overnight that South African gold output in July declined by 10.2%. However, December gold prices this morning have been pinned to those highs as if the market is poised to claw out more gains today. In the silver market, there has been 5 straight days of outflows from silver ETF’s, the silver market did not see much lift from the gold rally yesterday with only minimal gains this morning seen from Dollar weakness.

PLATINUM / PALLADIUM

Unfortunately for PGM market bulls the markets overnight do not appear to have garnered lift from news that total South African PGM output in July declined by 4.6% on a year-over-year basis. The palladium market has remained within a tight coiling range today despite periodic strength in gold, weakness in the dollar and a flicker of hope for increased Chinese demand from the Chinese five-year plan calling for increased stockpiles of strategic metals. Unfortunately, palladium ETF’s are not seeing any signs of interest from investors and platinum substitution of palladium predictions continue to flow from many market participants.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.