GOLD / SILVER

While gold and silver have started out on a weaker footing today the markets should find support from news that gold ETF holdings increased for the 8th straight session yesterday, with the chain of inflows the longest since January 6th. Silver ETF holdings also increased by 240,647 ounces and are 3.7% higher on the year.

PLATINUM / PALLADIUM

With the palladium market flaring to a 4-day high yesterday and promptly reversing course and starting out under pressure this morning, a temporary top might have been put in place. The world platinum market is slightly smaller than the world palladium market at 8 million ounces, but a private consultancy forecast calling for a deficit of only 68,000 ounces in platinum is still discouraging to the bull camp.

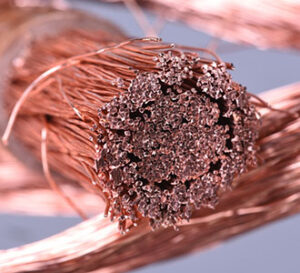

COPPER

Obviously, the broad-based risk off environment has contributed to the weakness in copper overnight with prices this morning matching 8-day lows. While the weakness in equities and fears of higher rates to control inflation are the primary bearish forces operating in the copper market, we also suspect that Chinese efforts to deflate soaring industrial material prices is adding to the downside tilt. In fact, coal futures, zinc futures, iron ore, and steel prices have corrected and in turn provided spillover pressure to copper prices early today.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.