Precious Metals

Gold: Gold prices are higher ahead of today’s release of the Fed’s October’s meeting minutes, which could signal how urgent the board feels about moving on interest rates and members’ opinions on the labor market. The state of the labor market has been a focal point for markets in regard to Fed policy, as the Fed has signaled it is more concerned with moving to support the labor market than it is about the inflation picture. Fed Funds futures are showing just under a 50% chance of a December rate cut from the Fed. Weak labor data could spur a gold rally, while stronger data and signs of labor market resilience may pressure prices and lead to a potential break below the key psychological support of $4,000, as it would also weigh on Fed policy easing expectations.

Data from the Cleveland Fed showed that 39,000 Americans were given advance notice of layoffs last month, and a report from ADP Research showed that employers cut 2,500 jobs a week on average during the four weeks ending November 1. Thursday’s highly anticipated September jobs report is likely to shape expectations of policy outcome at December’s meeting.

The long-term outlook for gold will remain supported by continued central bank purchasing.

Silver: Silver futures rose 1.80% to $51.44.

Platinum: Platinum is 0.3% higher at $1,560. Near-term physical demand has softened as automakers reduce the need for the metal and as longer-term EV adoption reduces demand. Greater Chinese inventories and early signs of a recovery in South African output have removed some supply-induced premium in recent weeks. However, the metal is still up more than 70% this year.

Base Metals

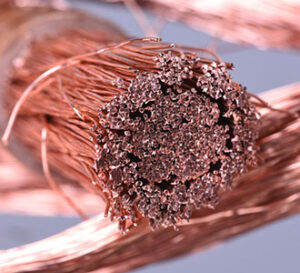

Copper: Copper prices are higher, recovering some ground from losses over recent days as the metal has been weighed down by a broader market pullback. Benchmark three-month copper on the LME rose 0.8% to $10,810. LME copper had shed nearly 5% when it hit a near two-week low on Tuesday from a record peak of $11,200 touched on October 29. A stronger Chinese yuan also helped support metals prices overnight.

Supply fears have subsided a bit; the cash LME contract was trading at a $39-a-ton discount to the three-month forward on Tuesday, indicating no shortage of near-term metal. Meanwhile, Freeport-McMoRan said it plans to restore large-scale production at its Grasberg mine in Indonesia in the second quarter of 2026, following a fatal incident that forced operations to halt in September.

There is little change regarding narrative on copper, with markets eyeing upcoming data out of the US for clues on Fed direction and for signs of economic activity. Sentiment has recently been weighed down by disappointing data out of China, where recent industrial data has been uninspiring even as major infrastructure and green energy investments support long-term demand. Speculation has been growing that Beijing will target the copper refining industry in its drive to reduce overcapacity, following calls from China’s nonferrous metals association for tighter oversight of new smelting projects.

Zinc: Zinc gained 0.6% to $3,005.

Aluminum: Aluminum advanced 0.9% to $2,805.

Tin: Tin climbed 1% to $37,225.

Lead: Lead dipped 0.1% to $2,022.

Nickel: Nickel added 0.1% to $14,650.

Interested in more futures markets? Explore our Market Dashboards here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.