TODAY—WEEKLY EXPORT SALES—USDA MONTHLY S/D REPORT—COMMITMENT OF TRADERS

Wire story reports agriculture market participants are expecting on Friday to see much lower government yield projections for U.S. corn and soybeans than were published a month ago, and if trade estimates are correct, the numbers will reflect an uncommon course-reversal from earlier lofty outlooks.

Overnight trade has SRW Wheat up roughly 3 cents, HRW up 5; HRS Wheat up 1, Corn is up 2 cents; Soybeans up 8; Soymeal up $2.50, and Soyoil up 25 points.

For the week, SRW Wheat prices are up 1 cent; HRW up 7; HRS down 6; Corn is up 9 cents; Soybeans up 17; Soymeal up $3.00, and; Soyoil up 55 points. Crushing margins are down 5 cents at $0.86; Oil share is unchanged at 34%.

Chinese Ag futures (January) settled down 29 yuan in soybeans, up 27 in Corn, up 32 in Soymeal, down 18 in Soyoil, and down 10 in Palm Oil.

Malaysian palm oil prices were down 19 ringgit at 2,795 (basis November) at midsession and set for its first weekly drop in three on rising output, demand worries.

U.S. Weather Forecast: The 6 to 10 day forecast for the Midwest looks to be fairly quiet during this time period. A front rolls in by the end of next week and bring light to moderate rainfall to MI, IN, and OH with things mainly dry elsewhere. Temps look to run below average to average for most of the region. The 11 to 16 day outlook for the Midwest has below average precip in most of the Plains and Midwest. Temps will run average to below in the Midwest and average in the Plains.The Southern Plains see little to no rainfall for the region with temps near average for the weekend and then back to below average in the 6 to 10 period.The Delta has light to moderate rainfall for most of the region in the 6 to 10 day time frame.

The player sheet had funds net buyers of 4,000 contracts of SRW Wheat; bought 17,000 Corn; sold 1,000 Soybeans; were net even in Soymeal, and; net even in Soyoil. We estimate Managed Money net long 16,000 contracts of SRW Wheat; long 41,000 Corn; net long 187,000 Soybeans; net long 24,000 lots of Soymeal, and; long 81,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures up roughly 2,300 contracts; HRW Wheat up 3,400; Corn up 18,400; Soybeans up 4,900 contracts; Soymeal down 4,100 lots, and; Soyoil down 5.

Deliveries were 60 Soymeal; 227 Soyoil; ZERO Rice; ZERO Corn; ZERO HRW Wheat; ZERO Oats; 2 Soybeans; 11 SRW Wheat, and; 1 HRS Wheat.

There were changes in registrations (Soybeans down 21; Soyoil down 127; Soymeal down 9)—Registrations total 95 contracts for SRW Wheat; ZERO Oats; Corn 220; Soybeans 2; Soyoil 2,304 lots; Soymeal 303; Rice ZERO; HRW Wheat 147, and; HRS 1,288.

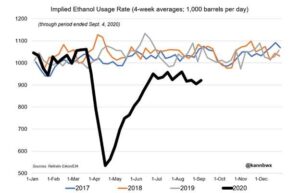

U.S. ethanol production for the week ended September 4th averaged 941,000 barrels per day (up 2.06% versus a week ago, down 8.02 % versus a year ago); stocks totaled 19.993 mil barrels (down 4.26% versus a week ago, down 11.14% versus last year); corn use for the week was 52.7 mil bu (92.5 mil last week) and versus the 57.0 mil bu needed to meet USDA projections.

Ethanol Inventories Show Big Decline; running counter to expectations that they’d grow, US ethanol inventories fall sharply this week–declining by 889,000 barrels to 19.9M barrels, according to the EIA; it’s the lowest they’ve been since early August, which is the last time they dipped under the 20M barrel mark; meanwhile, production rises 19,000 barrels per day, to 941,000 barrels per day; that’s the highest production since late July

The U.S. Department of Agriculture (USDA) today announced that low-income Iowa residents in 10 additional counties recovering from the effects of the derecho storm that hit the Midwest in August could be eligible for a helping hand from the USDA Disaster Supplemental Nutrition Assistance Program (D-SNAP); the agency also provided an extension for current SNAP households to report storm-related food loss and receive replacement benefits.

The average size of wildlife populations has plummeted by two-thirds worldwide since 1970 as forests were felled to grow food, green group WWF said Thursday, warning that harming ecosystems hikes the risk to humans of infectious diseases like COVID-19.

Saskatchewan crop report: Producers made significant harvest progress this week with 43 per cent of the crop now in the bin, up from 28 per cent last week and remaining well ahead of the five-year (2015-2019) average of 35 per cent for this time of year; an additional 29 per cent of the crop is swathed or ready to straight-cut; while rain in some eastern and northern areas delayed harvest progress, the majority of the province continued harvest operations this week. Estimated average crop yields at this time are 45 bushels per acre for hard red spring wheat, 38 bushels per acre for durum, 67 bushels per acre for barley, 35 bushels per acre for canola

Drought and floods did not affect this year’s grain production, which remains stable and positive, according to a Chinese Ministry of Agriculture and Rural Affairs officer; there will be a bumper harvest if no major disasters occur for the rest of the year; China’s agricultural production has reached a historically high level with 1.3 trillion tons of grain produced for five consecutive years; today, the Chinese people’s per-capita grain supply is more than 470 kg, besides a guaranteed supply of meat, eggs, vegetables and fish.

China has become a battleground for plant-based meat companies looking to tap into the world’s largest market for meat-consumption; American plant-based meat company Impossible Foods Inc. said Thursday it is awaiting regulatory approval to enter the China market, while rivals such as Beyond Meat have pushed forward with plans to set up production in China despite edgy relations between Beijing and Washington.

Whoever wins the presidential election, one thing is clear: The U.S. has turned a corner in its relations with China and is likely to maintain a harder line; in the past four years, President Trump, a longtime trade hawk, broke with decades of policy that broadly fostered closer ties between the two giants; seeing China as a growing and often dishonest competitor, his administration has imposed tariffs on two-thirds of Chinese imports, moved to curb Chinese investments in the U.S. and pressured allies to shun Chinese technology; advisers to Democratic presidential candidate Joe Biden say they share the Trump administration’s assessment that China is a disruptive competitor; this suggests that even with an administration change in January, friction between China and the U.S. would remain high.

Brazil farmers sell 48% of 2020/2021 estimated crop – AgRural – Reuters

Brazil should consider temporarily eliminating import tariffs on food staples like soybeans and corn, said the president of the country’s food supply and statistics agency Conab; eliminating duties could be an option to lower internal grain prices, which are historically high in the local currency; the levy on corn and soybean imports from outside Mercosur, which includes Paraguay, Uruguay and Argentina, is 8%; he proposed the measure as Brazil scrapped import duties on a 400,000-tonne rice quota through Dec. 31; if the tariff drops, Brazil could buy soybeans from countries like the United States, which is starting to harvest now; why not allow international trade flows in?,” he said, adding the same reasoning could apply to corn; Bastos is in favor of “open frontiers,” which Brazil’s Mercosur accord allows to regulate supply and demand domestically.

Argentine wheat was refreshed by rains on the Pampas grains belt last week but remained in need of more moisture if yields are to recover from a months-long dry spell, the Buenos Aires Grains Exchange said; large wheat-growing areas have had unusually dry conditions, prompting a reduction in sowing area and yield expectations; the exchange estimates that 6.5 million hectares were finally planted with wheat this season, with harvesting expected in December-January.

Sovecon has raised its forecast for Russia’s 2020 wheat crop to 83.3 million tons from 82.6 million, the Russian agriculture consultancy said; Siberia is reporting yields which are above previous expectations

Ukraine has exported 9.2 million tons of grain so far in the July 2020-June 2021 season compared to 10.3 million tons at the same point during the previous season, the economy ministry said; the volume is down due to a decline in corn sales, to 608,000 tons from around 1.9 million tons by the same date last season; wheat sales stood at 6.2 million tons, almost the same volume as a year earlier.

Ukrainian farms have started the 2020 corn harvest, threshing the first 107,000 tons from 25,800 hectares, Ukraine’s economy ministry said; it said a total of 38.7 million tons of grain had been harvested so far this year from 9.8 million hectares or 64% of the sown area

The condition of French grain maize declined slightly in the week to Sept. 7, with 60% of crops rated good or excellent condition compared with 61% the previous week, farm office FranceAgriMer said; grain maize harvesting had begun, with 1% of the crop area harvested by Sept. 7, in an earlier start than last year when none of the crop had been gathered by the same week

Euronext wheat rose on Thursday to its highest level in over three months as brisk demand from importers spurred a sharp rebound in U.S. futures; gains in Paris were capped, however, by a steep rise in the euro against the dollar, farmer selling interest and technical resistance on price charts; benchmark December milling wheat was up 1.50 euros, or 0.8%, at 190.25 euros ($226.11) a ton after earlier rising to 191.00 euros, its highest since May 25.

German pork exports to markets including China and Japan are likely to come to a halt following confirmation of a case of African swine fever in a wild boar in Germany on Thursday, German meat industry association VDF said; South Korea already announced that it was halting imports of German pork following the discovery of a case of African swine fever in a wild boar, not a farm animal, in eastern Germany.

The head of Germany’s farming association DBV on Friday called on China to impose only limited import restrictions and not a national import ban on German pork after a case of African swine fever (ASF) was found in a wild boar in Germany.

India’s palm oil imports in August dropped 13.9% from a year earlier to 734,351 tonnes, a leading trade body said, due to a sluggish recovery in demand from hotels and restaurants as local coronavirus cases continued to rise; the country’s soyoil imports dropped 10.4% year-on-year to 394,735 tons last month, while sunflower oil imports fell 31% to 158,518 tons, the Solvent Extractors’ Association of India (SEA) said.

La Niña conditions were present in August, and have a 75% chance of continuing through the Northern Hemisphere winter of 2020, a U.S. government weather forecaster said on Thursday; La Niña pattern is characterized by unusually cold temperatures in the equatorial Pacific Ocean.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.